An analysis of the cost system of Apple Plc

Introduction

Apple Plc is a confectionary company involved in the production of candy bars, chews and other sweets. The company currently uses traditional accounting techniques for its operations; however this has resulted in costing and pricing issues, which has created a level of friction between managers of the firm.

This report analyses the operations of Apple Plc with the aim of recommending techniques in management accounting to improve the processes of the company. The report introduces the concept of Management Accounting (MA) and explains the usefulness of its techniques in carrying out management functions. It then focuses on the costing, pricing and performance management challenges affecting Apple Plc and suggests MA techniques which can be used to resolve the issues raised, showing how management accounting techniques can be used to bring an improvement in the operational effectiveness of the company.

Management Accounting and Its Role in Strategic Decision Making:

Management accounting is a means of providing managers of a firm with both financial and non-financial information to assist them in achieving the goals of the organisation (Bhimani et al 2008). In attaining set organisational goals and targets managers are constantly taking decisions which impact on an organisation and its capacity to remain as a going concern. MA thus plays a key role in consistently providing information that aids the decision making process; aspects of which are stated below:

- Management accounting (MA) provides information that helps with the strategic management function of firm managers. This function defines the long term goals and objectives of the firm and MA provides a framework for management to define the future shape of the business (Collier and Gregory 1995).

- Critical decisions taken include which competitive strategies the firm should adopt, such as whether to go for a differentiation or cost leadership strategy, and the investment or capital project that should be undertaken. Techniques such as the Competitor Analysis and Balanced Scorecard can be used as decision making tools in this regard.

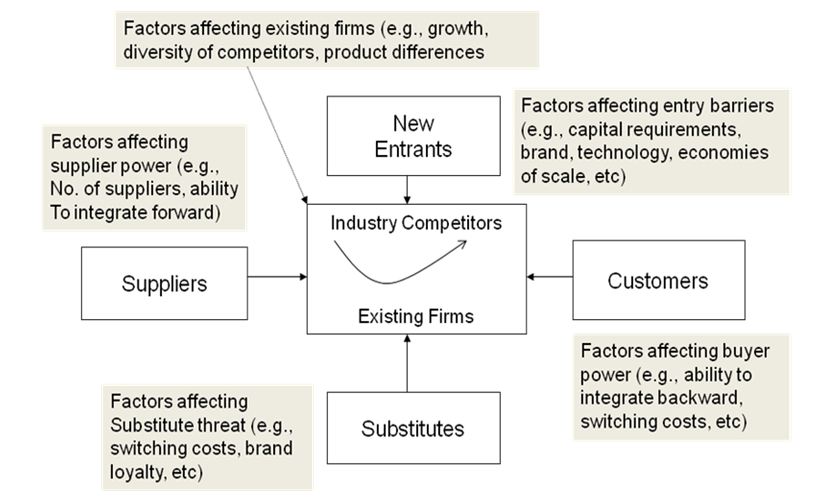

The Competitor Analysis reviews the position of the firm by an analysis of its competitors and the competitive environment (Gong and Zhang 2007). Taking into account Porter’s 5 forces model (Porter 1995), this technique enables a firm to determine its position in the industry, its competitive advantage, strengths and weaknesses, by taking into the cognisance the state of the industry, the strengths of its competitors, their competencies and their weaknesses. This enables the management of a firm to map out strategies on how to actualise the firms’ vision and compete effectively and profitably in the market. Motorola and Xenox are firms who carried out competitive intelligence research to analyse their competitors and their mode of operation, set new targets and developed strategic plans to achieve their targets (Gong and Zhang 2007).

Fig 1: Porter’s 5 Forces Model (Source: Strategic Accounting Lecture 2)

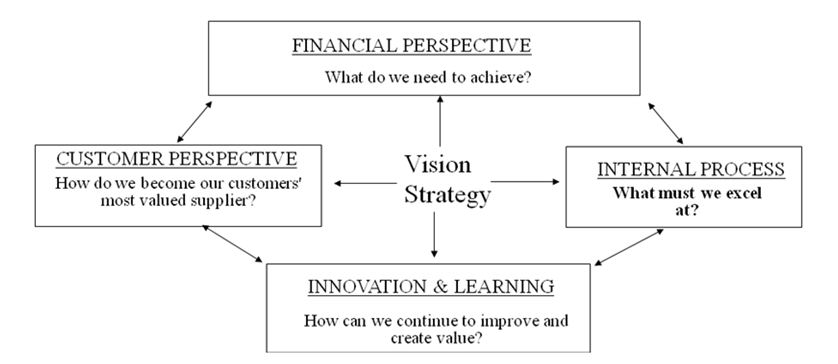

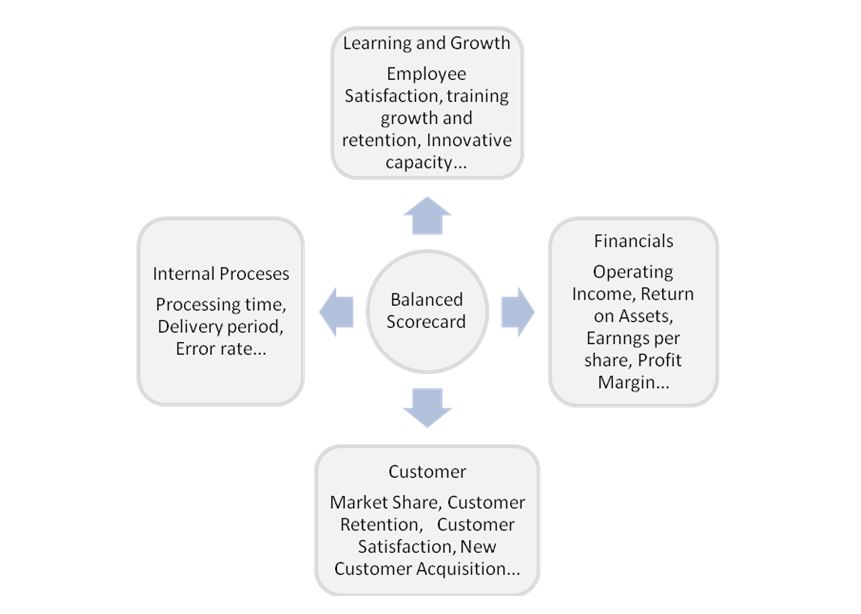

The Balanced Scorecard (BSC) is ‘a comprehensive set of performance measures designed to assist managers in formulating and implementing competitive strategies and monitoring performance with respect to them’ (Banker and Johnston 2002).

By measuring a firm’s activities from four perspectives, namely financial, learning and growth and innovation, customer satisfaction and internal business process, the BSC compliments the financial measure of company performance with the additional three non-financial measures and establishes a link between previously disconnected elements of the business through the understanding of the link between cause and effect (Bhimani et al 2008; Kaplan and Norton 2001; Mangena 2010).

Fig 2: The Four Perspectives of BSC (Source: Strategic Accounting, Lecture 8)

Fig 2: The Four Perspectives of BSC (Source: Strategic Accounting, Lecture 8)

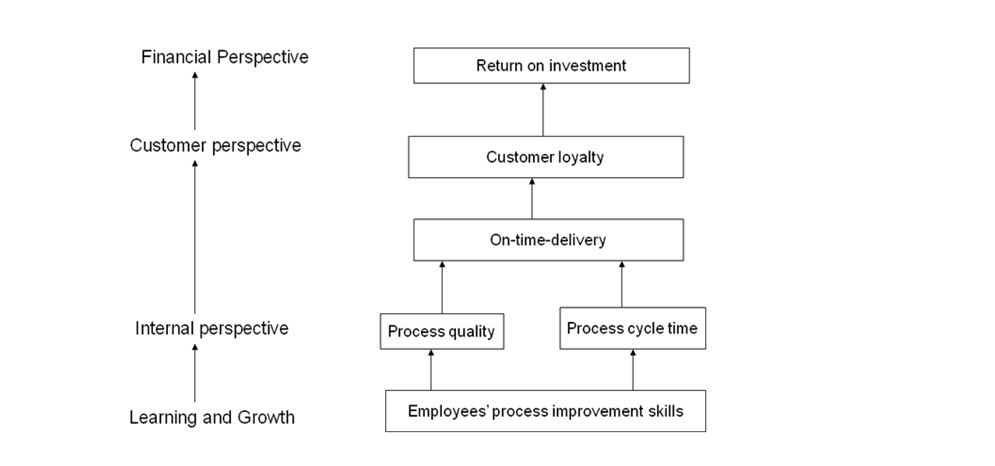

Fig 3: Establishing the Link between the Four Perspectives (Source: Strategic Accounting, Lecture 8)

Fig 3: Establishing the Link between the Four Perspectives (Source: Strategic Accounting, Lecture 8)

The firm can then set targets based on this broad view and develop strategies to achieve its goals. Furthermore, it has been argued that capital investment decisions are narrowly focused on financial appraisal tools and should essentially capture intangible aspects of the business (Alcaraan and Northcott 2006). Thus in deciding on which project to undertake, Strategic Investment Appraisal can be incorporated into BSC to develop an integrated framework which utilises financial and non-financial measures for evaluating business propositions (Alcaraan and Northcott 2006).

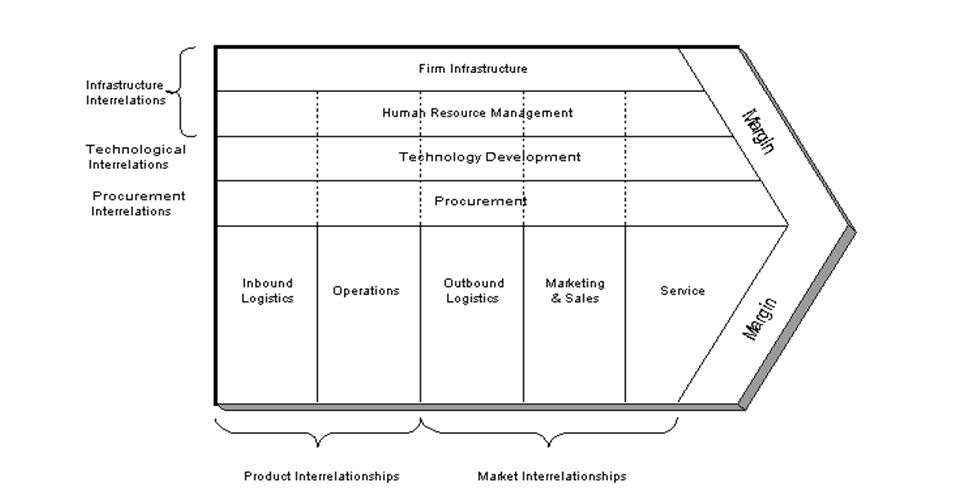

Information from MA is equally instrumental in management control within the organisation. Here operations are monitored with a view to identifying inefficient aspects and improve on the operational structure of the business. Strategic decisions taken include whether to buy or produce a particular product. MA techniques, such as Value Chain Analysis and Benchmarking, are highly effective here. A value chain is ‘the set of linked value creating activities all the way from the basic raw material sources for the component suppliers through to the ultimate end-use product delivered into the consumers’ hands’ (Shank 1989); while Benchmarking is the process of ‘measuring a firm’s performance against ‘best-in-class firms’ with the aim of identifying the best practices that can be adopted and implemented by the organisation so as to improve company performance’ (Freytag and Hollensen 2001). Through a critical analysis of the value chain of the organisation costs, means of gaining a competitive advantage can be gained by making value adding adjustments to the value chain, by modifying or eliminating certain activities that will make the firm’s processes more efficient (Shank and Govindarajan 1993). Also, by an appropriate benchmarking process the firm can compare its performance with those of its competitors on key areas of the business and determine areas that need to be improved upon. A practical example of a firm utilising the VCA and benchmarking technique is the UK retailer Sainsbury. By recognising activities in the value chain and analysing the cost drivers, capitalising on the linkage between the firm and its suppliers, making adjustments and benchmarking activity costs with industry average (Dekker 2002), Sainsbury was able to successfully incorporate the VCA into its business model and take decisions which enhanced its operational efficiency.

Fig 4: A Typical Value Chain Analysis Structure (Source: www.learningmarketing.net)

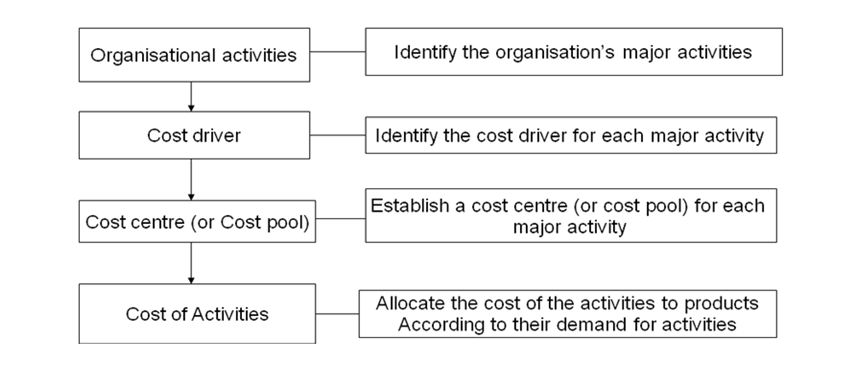

MA also provides information relevant to planning and decision-making within an organisation. Such decisions include cost and product pricing decisions to maximise profits and whether to maintain or change strategic plans that are being implemented. Techniques such as Activity Based Cost System (ABC) and Strategic Profitability Analysis are relevant tools in this regard. ABC technique reveals the relationship between activities and costs and gives a deeper understanding of how a firm utilises its resources by focusing on individual activities (Bhimani et al 2008). The model is used to determine activities that cause costs, pick the cost drivers, calculate the associated cost and assign the costs to products based on the activities that were carried out in the production process (Bhimani et al 2008). This helps the firm make appropriate pricing decisions as well as identify points where resources usage is not optimised and costs are not well managed, so that necessary adjustments can be carried out to reduce costs and maximise profits. Strategic profitability analysis is a technique which can be used by managers to evaluate how successful the strategies implemented have been in creating value for the firm (Mangena 2010). By focusing on the competitive effectiveness, which measures how well the firm achieved its goals, and operational effectiveness, which is a measure of the amount of resources utilised within the period (Mangena 2010), strategic profitability analysis combined with ABC enables managers to evaluate the performance of the firm relative to its set targets (Innes and Mitchell, 1995) and ultimately decide whether to maintain or change adopted strategies e.g. to build, hold, harvest or divest in the market.

Fig 4: ABC Process (Source: Strategic Accounting Lecture 3)

Fig 4: ABC Process (Source: Strategic Accounting Lecture 3)

Information generated by MA is also used in producing accurate financial reports. ABC is also a useful tool for this function. With its precise determination of appropriate product costs and prices, outputs from ABC are used to prepare firm’s income statements and balance-sheets.

Innes and Mitchell (1995) also posit that ABC is a useful tool in making stock valuations for financial reporting.

Costing System of Apple Plc

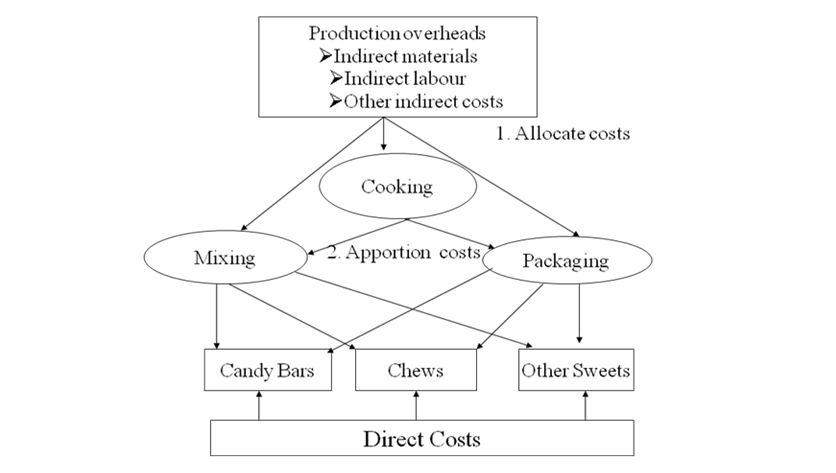

Apple Plc currently employs absorption-based costing with the current costing structure expressed below.

Fig 5: Traditional Cost Structure of Apple Plc

Fig 5: Traditional Cost Structure of Apple Plc

This is a traditional technique which allocates both fixed and variable costs to its products (Johnson and Kaplan 1987) and employs volume driven criteria such as labour hours and machine hours to assign company expenses to individual products (Cooper and Kaplan 1992). This allocation of full costs to products is against the stance by scholars that variable costs are the crucial factors for consideration in product decisions (Cooper and Kaplan 1988), thus may not provide accurate information about product costs (Johnson and Kaplan 1987). Also Cooper and Kaplan (1992) assert that absorption costing does not effectively measure the cost of resources used in the production process as the resource demands for production are not proportional to the amount of units produced and sold. Furthermore, absorption costing does not reflect the influence that technological advancement and competition has on the modern day business environment (Johnson and Kaplan 1987) and is more appropriate when the firm has low overheads and has limited product variety (Mangena 2010). The outcome of using absorption costing could therefore be the under-costing of low volume products and over-costing of high volume products (Myers 2009).

This is current the scenario with Apple Plc. Despite the commonality in certain aspects of the production process of the three products, each product will eventually enter into a phase peculiar to it. This implies that Apple Plc’s candy bars, chews and other sweets will have different mixing, cooking and packaging requirements and different labour and manpower needs. Also aspects of the materials required for production, such as the type and quantity of flavours, will differ and each product will be produced in varying quantities, which will depend on the demand for the product. Thus there will be variations in costs of purchasing raw materials, in requisitions for raw materials and finished products and machine set up and run time. Different marketing strategies may also be adopted by the divisions, also leading to cost variation. The implication of these is that the manufacture of each product attracts varying amounts of resources and activities thus varying amounts of costs will be incurred. The pointer therefore is that by adopting absorption costing Apple Plc has employed an inappropriate technique which has over-allocated costs to some items and under-allocated to others.

This has led to a wrong pricing of products due to a cost system which is not a true representative of the individual demand of each product on the resources of the firm (Johnson and Kaplan 1987; Cooper and Kaplan 1992); thus wrong decisions will be taken about product sourcing, pricing, mix and response to rival products (Johnson and Kaplan 1987) and the firm may end up adopting a wrong strategy (Cooper and Kaplan 1988).

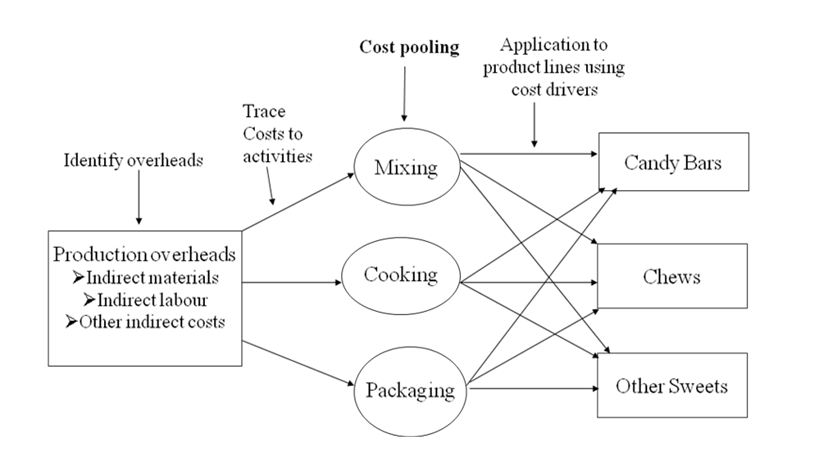

This varying amount of resource requirement for each product coupled with the multi-product nature of the Apple Plc, as well as its reliance on highly automated processes, makes Activity Based Costing (ABC) ideal for the firm. However, given that volume cannot be eliminated as a cost factor, elements of absorption costing will be combined with ABC to develop an appropriate cost structure.

Application of ABC by Apple Plc will give visibility to the firm’s costs by detailing its activities and their respective costs and categorising them by the way in which they are consumed (Innes and Mitchel 1995). Aspects of Apple Plc activities and their cost drivers are shown in Table 1.

| Activity | Cost Driver |

| Procurement of Raw Materials | Frequency of procurement |

| Invoicing | Number of Invoices and associated materials |

| Machine set up | Set up time |

| Production Runs | Number of runs |

| Placement Orders | Number of orders |

| Marketing and Advertising | Frequency of advertising |

Table 1: Sample Activities and Cost Drivers in Apple Plc Processes

By identifying its major activities and the cost driver for each activity (some of which will be volume based) and allocating each activity to a cost centre, calculating the cost driver rate and finally assigning the costs appropriately to the products depending on the level of activity required (Tayles n.d.), a more balanced costing system will result and allocation of costs to the products will be based on the resources utilised in production, thus a fair costing and pricing system will be developed. In addition, by identifying actual resource consuming activities, Apple Plc can review and adjust inefficient aspects and save costs (Innes and Mitchel 1995). Furthermore certain costs are driven by customers, such as the number of sales visits made or the amount of shipments to the customer; by combining ABC with Customer Profitability Analysis (Tayles n.d.; Bhimani et al 2008), Apple Plc can determine its most and least profitable customers per product and take strategic decisions based on the potential of building and sustaining a value adding relationship with the customers.

Fig 6: ABC Cost Structure for Apple Plc

Fig 6: ABC Cost Structure for Apple Plc

This is not an easy process and assigning the costs could involve complex calculations. However, in the long run, costing and product pricing decisions will be more accurate.

Performance Management System of Apple Plc

The performance management system in place at Apple Plc based on attaining a minimum profit margin of 25% is purely a financial measure. These measures have the advantage of being easy to understand, easily comparable and are reliable. However, with the traditional costing techniques in place at Apple Plc and the associated pricing issues, some managers would attain their targets with more ease than others simply because of the inappropriate product pricing. Also the use of profit margin as sole criteria is inadequate as it is restrictive, is subject to manipulation, encourages investment myopia and sub-optimisation along with other decisions which boost short-run financial figures to ensure managers receive their bonus at the expense of the long-run performance of the firm (Bhimani et al 2008; Mangena 2010). These reflect the need for a more balanced performance management system and could be achieved with the balanced scorecard technique combined with benchmarking.

The balanced scorecard technique combines financial and non-financial information in the evaluation process. This leads to a more robust performance measure for managers, which will reflect a broader view of the firm’s performance and will have an effect on the behaviour of both managers and employees (Kaplan and Norton 2001). Aspects of the criteria are shown in Fig 7.

Fig 7: BSC and Performance Management Criteria

Fig 7: BSC and Performance Management Criteria

Apple Plc should setting appropriate targets based on criteria that include aspects of all four perspectives of the BSC and benchmark with a leading competitor in the industry. This will give a performance evaluation system that will eliminate the effect of uncontrollable factors that are beyond the managers’ influence and ensure an improved performance from managers due to the thorough nature of the evaluation process (Bhimani et al 2008). It will also give a more reliable indication of both the potential of the firm to achieve its long term strategies and its potential future performance (Bhimani et al 2008).

Conclusion and Recommendation

MA techniques have been shown to be very useful tools in enhancing the capacity of managers to take strategic decisions associated with the various management functions. In the case of Apple Plc, it is recommended that despite the shortcomings of absorption costing and the traditional methods as a whole, elements of it should be combined with MA techniques of Activity Based Costing and Customer Profitability Analysis to improve the costing system of the firm and give a better reflection of the true costs of its products. Also by applying the Balanced Scorecard and Benchmarking technique, Apple Plc can develop a more comprehensive means of performance management.

References

Alkaraan, F. and Northcott, D. (2006). Strategic Capital Investment Decision-Making: A Role for Emergent Analysis Tools? A Study of Practice in Large UK Manufacturing Companies, British Accounting Review, vol. 38, pp. 149-173.

Banker, D. and Johnston, H. (n.d.). Strategic Management Accounting and Control. Available at http://astro.temple.edu/~banker/Accounting/StrategicManagementAccountingHandbookChapter.pdf (accessed 5 April, 2010).

Bhimani, A., Horngren, C., Srikant, D. and Foster, G. (2008). Managemant and Cost Accounting, 4th edition, Prentice Hall.

Collier, P. and Gregory, A. (1995). Strategic Management Accounting: A UK Hotel Case Study. International Journal of contemporary hospitality management, vol. 7, no. 1, pp 16-21. Available at http://www.emeraldinsight.com/Insight/ViewContentServlet?Filename=/published/emeraldfulltextarticle/pdf/0410070103.pdf Accessed 20, March 2010.

Cooper, R. And Kaplan, R. (1992). Activity –Based Systems: Measuring The Costs of Resource Usage, Accounting Horizons, vol 6, no. 3, pp. 1-12.

Dekker, H. (2003) ‘Value Chain Analysis in Interfirm Relationships’; A Field Study, Journal of Management Accounting Research, vol. 14, pp. 1-23

Freytag, P. and Hollensen, S. (2001). The Process of Benchmarking, Bench-learning and Bench-action. The TQM magazine, vol. 13, no.1, pp. 24-34.

Gong, L. (2007). Study on the Methods and Applications of Strategic Management Accounting. International Journal of Business and Management, vol. 2, no. 5, pp. 189-192. Available at http://www.ccsenet.org/journal/index.php/ijbm/article/viewFile/2081/1961 accessed 8 April, 2010.

Innes, J. and Mitchell, F. (1995). A Survey Of Activity Based Costing on UK’s Largest Companies, Management Accounting Research, vol. 6, pp. 137-153.

Kaplan, R. and Norton, D. (2001). Transforming The Balanced Scorecard From Performance Measurement to Strategic Management: Part I, Accounting Horizons, vol. 15, no. 1, pp. 87-104.

Johnson, H. and Kaplan, R. (1987). The Rise and Fall of Management Accounting, Management Accounting, vol. 68, no. 7, pp. 22-30.

Mangena, M. (2010). Strategic Accounting Lecture notes, University of Bradford, School of Management.

Myers, J. (2009). Traditional vs Activity Based Product Costing Methods: A Field Study In Defence Electonics Manufacturing Company. ASBSS Annual Conference.

Porter, M. (1995). The Competitive Advantage of Nations. Macmillan Press Ltd, pp 40-44.

Shank, J. (1989). Strategic Cost Management: New Wine or Just Wine Bottles? Journal of Accounting Research.

Shank, J. and Govindarajan, A. (1993). Strategic Cost Management and the Value Chain, Management Accounting Research, vol. 7, no. 2, pp.185 – 203.

Tayles, M. (n.d.) Activity Based Costing. Association of International Accountants.