Case Study of the Financial Investments of Lenovo Company

Number of words: 8573

Introduction to Chapter one:

This study will focus on the economic funding of the Lenovo organization. The principal emphasis may be on the worldwide market. It will give cognizance of how Lenovo uses the enterprise version to conquer the different competitors in the marketplace. The results of its five-year revenue evaluation may compare with those from different competitors collectively with its average performance and prospectus.

This indicates that Lenovo’s process advanced level, implying that the company has already figured out brand-call photo localization in the United States. . Lenovo has become the worldwide software program agency (earnings) that has its package flairs seven international flairs in making it the most accessible organization for licensing and settlement. Lenovo is additionally one of several essential international companies (income), and it has its manufacturing flair in seven international places. Its products are advertised and advertised in almost 80 international places.

The second chapter is devoted to a review of the literature.

Financial forecasting is a time-consuming technique that calls for being an affected person. The reason is that important facts for assumptions need to be accrued cautiously for the reliability of the forecast. All variables want to be clarified; as an example, expected coins needed for the destiny, profit, personnel wanted, and extra. In the case of uncertainty about these variables, assumptions must be made on enterprise history, or increase the revenue on predicted changes within the market. Forecasts of the destination state of the financial system are an important entry into the decision-making procedure. Once the forecast is finished, it ought to be revisited periodically. An up-to-date forecast can enable you to see if dreams from the past have come true or not. Formal paraphrase accurate forecast may be extraordinarily helpful, at the same time as making an incorrect forecast can result in high prices including more groups of workers or inventory.

Research has been performed and more of it is being performed to discover a more reliable and accurate method of monetary forecasting. The majority of this research’s focus is on theoretical studies, while the rest of the studies are on implemented technology, roughly forecasting. But this research nevertheless didn’t achieve the aim precisely. To continue to exist and compete with the commercial enterprise competitors in the marketplace and to fulfill consumer calls, it’s important that ports are managed and destiny planned carefully. It’s far more necessary to have the right statistics and song in the mildest of forecasts because it’s the most effective area that shareholders can control.

In today’s intensely competitive marketplace, agencies require more making plans. Companies will incur additional costs if they do not develop unique business plans. But a properly modeled forecast can defend the agencies against those unnecessary fees. Misguided forecasts additionally have an effect on the market’s reliability and on dating with 10 clients, suppliers, and partners. So the principal query that arises here is whether or not it’s possible to make correct forecasts continuously.

One of the boundaries in these studies became the potential of facts. The machine consists of thousands of variables. Some of these variables involve classified statistics, which are tough to gain from agencies as an observed case. The other difficult aspect is the scarcity of papers or other forms of resources on this one-of-a-kind subject. Forecasting and record mining are quite new in terms of the meaning of uncovered topics.

Introduction

Lenovo is an excellent example of a company that rose to the top by invention and originality, tenacity, and verbal communication with customers. Lenovo is now regarded as one of the leading computer manufacturers. Capsules, laptops, ultrabooks, all-in-one desktops, PCs, nettops, and their add-ons are all manufactured by them. Lenovo produces high-quality, long-lasting products at an affordable price. And they appear to be here to stay.

Financial forecasting is a time-consuming technique that calls for being an affected person. The reason is that important facts for assumptions need to be accrued cautiously for the reliability of the forecast. All variables want to be clarified; as an example, expected coins needed for the destiny, profit, personnel wanted, and extra. In the case of uncertainty about these variables, assumptions must be made on enterprise history, or increase the revenue on predicted changes within the market. Forecasts of the destination state of the financial system are an important entry into the decision-making procedure. Once the forecast is finished, it ought to be revisited periodically. An up-to-date forecast can enable you to see if dreams from the past have come true or not. Formal paraphrase accurate forecast may be extraordinarily helpful, at the same time as making an incorrect forecast can result in high prices including more groups of workers or inventory.

Research has been performed and more of it is being performed to discover a more reliable and accurate method of monetary forecasting. The majority of this research’s focus is on theoretical studies, while the rest of the studies are on implemented technology, roughly forecasting. But this research nevertheless didn’t achieve the aim precisely. To continue to exist and compete with the commercial enterprise competitors in the marketplace and to fulfill consumer calls, it’s important that ports are managed and destiny planned carefully. It’s far more necessary to have the right statistics and song in the mildest of forecasts because it’s the most effective area that shareholders can control.

In today’s intensely competitive marketplace, agencies require more making plans. Companies will incur additional costs if they do not develop unique business plans. But a properly modeled forecast can defend the agencies against those unnecessary fees. Misguided forecasts additionally have an effect on the market’s reliability and on dating with 10 clients, suppliers, and partners. So the principal query that arises here is whether or not it’s possible to make correct forecasts continuously.

One of the boundaries in these studies became the potential of facts. The machine consists of thousands of variables. Some of these variables involve classified statistics, which are tough to gain from agencies as an observed case. The other difficult aspect is the scarcity of papers or other forms of resources on this one-of-a-kind subject. Forecasting and record mining are quite new in terms of the meaning of uncovered topics.

For its clients, the agency attempts to develop extraordinary, revolutionary, and particularly fantastic desktops. They are free of institutional restrictions and ties that might divert or obstruct their ability to produce first-rate viable Chinese. Lenovo pledges to provide innovative and exciting products to meet the needs of their clients. They even go so far as to alter the degree to which the expectations are exceeded. Lenovo wants to do business from a global perspective, with its perspective and commitment to creating a fantastic era for people who see technology as a tool for doing interesting things.

Lenovo does not squander resources and time by having a small number of product classes. As a result, Lenovo does not place any effort on ineffective divisions. In trendy, PEST analysis assesses a market’s capabilities, predicts growth or decline, and hence market beauty. The SWOT aspects can be decided using the PEST analysis.

PEST control is a concept for defining the framework of the primary ecosystems that a business should consider when developing long-term strategic strategies.

External elements, by the way, might vary dramatically in a specific firm based solely on the products and services provided, as well as the organization to which it belongs. Such methods of external analysis and the environment are a way to achieve success for any firm that wants to win in aggressive advertising. In this study, PEST will be utilized to focus on understanding the Lenovo corporation’s external environment and attempting to predict the significant influence of those external factors on their business environment.

Political variables influencing an organization’s marketplace are represented by the letter “p.”

The degree of bureaucracy, legal rules and regulations, legalization and policies, rule of law, press freedom, tariff restrictions, and exchange are the factors to consider.

Computer systems have become increasingly integrated into people’s lives in recent years. Computer systems have been utilized in businesses and other areas since the last century to help industries, hospitals, and other structures boost manufacturing and productivity. At the same time, modern technology has prompted a slew of new challenges, including environmental pollution, fitness, and strength consumption. The inexperienced piece is inspired by thinking about such concerns as the European Union, China, and various worldwide locales. As a result, laptop structures should no longer emit significant sound pollution, and power consumption should be minimal. The isotopic index in Lenovo organizations is less than 30db. As a result, Lenovo has completed the phase of noise pollution.

As a result of the fact that many assembly strains are Chinese language languages, Lenovo also established a manufacturing plant in China. China’s export tariffs were reduced to 9.1% in 2005, the same year it joined the World Trade Organization. As a result, the laws are aimed at companies that are expanding globally. “E” is the following letter. It denotes financial variables such as hobby costs and inflation, disposable earnings, labor costs and delivery, and the globalization effect. The letter “s” stands for social custom. Its social research and education, way of life attitudes and selection, population growth price and age profiles, and a whole lot more. The letter “t” comes before it. This is done regularly for technological elements such as the impact of energy technology, the rise in long-distance running, and the gift of a day-to-day diploma of technological development, as well as the impact of technology on artwork technique and productivity. For monetary reasons, as a result of the 2008 bankruptcy, the financial industry tends to want more space. However, at the worst possible time, the Chinese language administration issued a new monetary policy, which was renamed “superior monetary policy” and “loose and comfortable monetary policy.”

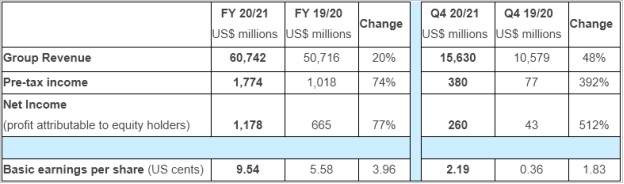

Source:https://investor.lenovo.com

Financial forecasting is a time-consuming technique that calls for being an affected person. The reason is that important facts for assumptions need to be accrued cautiously for the reliability of the forecast. All variables want to be clarified; as an example, expected coins needed for the destiny, profit, personnel wanted, and extra. In the case of uncertainty about these variables, assumptions must be made on enterprise history, or increase the revenue on predicted changes within the market. Forecasts of the destination state of the financial system are an important entry into the decision-making procedure. Once the forecast is finished, it ought to be revisited periodically. An up-to-date forecast can enable you to see if dreams from the past have come true or not. Formal paraphrase accurate forecast may be extraordinarily helpful, at the same time as making an incorrect forecast can result in high prices including more groups of workers or inventory.

Research has been performed and more of it is being performed to discover a more reliable and accurate method of monetary forecasting. The majority of this research’s focus is on theoretical studies, while the rest of the studies are on implemented technology, roughly forecasting. But this research nevertheless didn’t achieve the aim precisely. To continue to exist and compete with the commercial enterprise competitors in the marketplace and to fulfill consumer calls, it’s important that ports are managed and destiny planned carefully. It’s far more necessary to have the right statistics and song in the mildest of forecasts because it’s the most effective area that shareholders can control.

In today’s intensely competitive marketplace, agencies require more making plans. Companies will incur additional costs if they do not develop unique business plans. But a properly modeled forecast can defend the agencies against those unnecessary fees. Misguided forecasts additionally have an effect on the market’s reliability and on dating with 10 clients, suppliers, and partners. So the principal query that arises here is whether or not it’s possible to make correct forecasts continuously.

One of the boundaries in these studies became the potential of facts. The machine consists of thousands of variables. Some of these variables involve classified statistics, which are tough to gain from agencies as an observed case. The other difficult aspect is the scarcity of papers or other forms of resources on this one-of-a-kind subject. Forecasting and record mining are quite new in terms of the meaning of uncovered topics.

Rather, the government intends to comply with the clinical management approach, sophisticated technology and period, guide the goods completed or beyond the enterprise famous or international desired, as stated in article 6 of the People’s Republic of China law on product fantastic and present the award to enterprises whose products have achieved or exceeded global fashion (National People’s Congress, 1993). As an international organization, Lenovo will link the period of IBM by providing excessively wonderful products and acquiring authorities’ assistance from the criminal. As a result, for the ethical, because the number of training levels has increased, the human diathesis has also increased. As a result, protecting criminal strength has become commonplace in today’s society.

If the corporation engages in illegal behavior, it may be removed from the market with the help of customers, who will not purchase their products. Faith, honesty, and appropriate behavior are also ethical issues for an employer. Customers, innovation, faith, and equity are all serviced by Lenovo’s price (Lenovo, 2005). So, in the next 5 to 10 years, this overall ethical development trend is good for Lenovo’s workplace environment.

The risk of new entrants

The bargaining power of companies

The types of vendors within the enterprise wherein Lenovo operates could also number in the hundreds in comparison to the purchasers. This means the providers have a great deal less control over expenses, which makes the bargaining power of companies inclined to pressure. The products that the providers provide are pretty standardized, much less differentiated, and feature low switching charges. This makes it much less difficult for customers like Lenovo to manipulate carriers. This makes the bargaining energy of companies a taker strain. The suppliers do not affect the unique merchandise inside the corporation. This indicates there are not any precise substitutes for the products apart from people who the companies provide. This makes the bargaining strength of vendors a more potent strain in the agency. The providers do not present a genuine threat for prior integration into the organization in which Lenovo operates.

Lenovo should buy uncooked materials from its providers at an espresso price. If the prices or merchandise aren’t suitable for Lenovo, it’s going to then transfer its companies because switching costs are low. It’s going to have more than one company within its delivery chain. For instance, Lenovo ought to have specific carriers for its notable geographic countries. This way, it can be certain of overall performance inside its delivery chain. Because the enterprise is an important client for its vendors, Lenovo can gain from growing close relationships with its carriers at some stage in which each of them gains.

Customer Bargaining Power

Financial forecasting is a time-consuming technique that calls for being an affected person. The reason is that important facts for assumptions need to be accrued cautiously for the reliability of the forecast. All variables want to be clarified; as an example, expected coins needed for the destiny, profit, personnel wanted, and extra. In the case of uncertainty about these variables, assumptions must be made on enterprise history, or increase the revenue on predicted changes within the market. Forecasts of the destination state of the financial system are an important entry into the decision-making procedure. Once the forecast is finished, it ought to be revisited periodically. An up-to-date forecast can enable you to see if dreams from the past have come true or not. Formal paraphrase accurate forecast may be extraordinarily helpful, at the same time as making an incorrect forecast can result in high prices including more groups of workers or inventory.

Research has been performed and more of it is being performed to discover a more reliable and accurate method of monetary forecasting. The majority of this research’s focus is on theoretical studies, while the rest of the studies are on implemented technology, roughly forecasting. But this research nevertheless didn’t achieve the aim precisely. To continue to exist and compete with the commercial enterprise competitors in the marketplace and to fulfill consumer calls, it’s important that ports are managed and destiny planned carefully. It’s far more necessary to have the right statistics and song in the mildest of forecasts because it’s the most effective area that shareholders can control.

In today’s intensely competitive marketplace, agencies require more making plans. Companies will incur additional costs if they do not develop unique business plans. But a properly modeled forecast can defend the agencies against those unnecessary fees. Misguided forecasts additionally have an effect on the market’s reliability and on dating with 10 clients, suppliers, and partners. So the principal query that arises here is whether or not it’s possible to make correct forecasts continuously.

One of the boundaries in these studies became the potential of facts. The machine consists of thousands of variables. Some of these variables involve classified statistics, which are tough to gain from agencies as an observed case. The other difficult aspect is the scarcity of papers or other forms of resources on this one-of-a-kind subject. Forecasting and record mining are quite new in terms of the meaning of uncovered topics.

The danger of different products

There are only some substitutes to be had for the products which might be produced within the organization in which Lenovo operates. The best few substitutes can also be produced by low-profit-earning industries. Due to this, there may be no ceiling on the maximum income that organizations can earn in the company in which Lenovo operates. All of these elements combine to make the risk of various products a taker pressure within the business. The handiest few substitutes available are of immoderate brilliance. However, they are also more costly. Organizations generating within the business agency wherein Lenovo operates sell at a lower rate than substitutes, with good enough super. This suggests that clients are an awful lot less likely to change for opportunity merchandise. This indicates that the risk of alternative merchandise is within the commercial enterprise organization.

Lenovo can be recognized for offering more exquisite products. As a result, buyers may select its products, which provide greater value at a lower price when compared to alternative merchandise that provides greater quality but at a lower price. Lenovo can pay attention to differentiating its products. This could indicate that customers see its merchandise as particular and do no longer shift without trouble to substitute products that don’t offer the same specific advantages. It can provide such unique advantages to its clients with the useful resource of better recording their dreams through marketplace research and supplying what the patrons’ goals are.

Competition amongst modern agencies

The number of competitors in the industry in which Lenovo operates is simply numerous. Most of these are also big. This indicates corporations in the industry will no longer make moves without being unnoticed. This makes the rivalry among present organizations an intake strain in the enterprise. Just a few competitors have a huge market percentage. This denotes those who will take aggressive actions to fulfill their role and become market leaders. This makes the opposition among current companies a more potent pressure on the organization. The industry in which Lenovo is growing every year is expected to try to do that for a couple of years in advance. A green enterprise boom means that competition is a smaller quantity probable to own interaction incomplete actions thanks to the very fact that they’re not trying to capture market percentage from each other. This makes the contention among existing firms a source of stress within the business enterprise. The constant costs are excessive in the business enterprise in the course of which Lenovo operates. As a result, the enterprise’s organizations strive to achieve their full potential. This method, moreover, lets corporations lessen their fees at the same time they call for slackening. This makes the opposition among current companies a stronger force inside the industry. The goods produced within the business enterprise wherein Lenovo operates are drastically differentiated. As a result, it’s far harder for competing companies to win the purchasers of each distinctive because all their merchandise is one of a kind. This makes the competition among the present agencies a stakeholder pressure within the industry. The assembly of merchandise inside the enterprise calls for an increase in potential with the aid of large increments. This makes the industry vulnerable to disruptions in the supply-call for balance, regularly resulting in overproduction. Overproduction approach: Corporations want to bog down expenses to make certain that their products are promoted. This makes the competition among modern-day corporations a more potent source of stress inside the industry. The leave boundaries within the enterprise are especially immoderate due to the excessive investment required in capital and assets to make them work. Going out barriers are also an excessive way of implementing government recommendations and regulations. This makes corporations within the enterprise reluctant to go away from the commercial enterprise, and those held to deliver even at low profits. This makes the rivalry amongst current groups a stronger force within the corporation. The techniques of the firms in the enterprise are diverse, which shows that they may be unique to each different in phrases of strategy. This makes the contention among modern agencies a sturdy pressure inside the industry.

Lenovo wishes to be conscious of differentiating its products so that the actions of competitors may also have an awful lot less effect on its clients who are searching for its precise products. Because the industry is growing, Lenovo can interest new clients in a desire to win those from gift corporations. Lenovo can behavior market research to apprehend the supply-call for the situation within the organization and prevent overproduction.

Competition in the technology industry

One of the most important concerns in tech coverage is trying to understand just how competitive the tech enterprise is. Looking at the mentioned marketplace stocks, the industry would possibly appear smooth. However, technology is still a rapidly evolving market, and there are many characteristics of the enterprise that run counter to the notion that market proportion is an accurate indicator of market power. There are two problems with withdrawing traces around tech markets, and then the use of the one marketplace share as the primary predictor of competitiveness. First, the position tech products play in society can shift as they evolve, suddenly becoming competition for other products and services in markets that were formerly regarded as unrelated.

Financial forecasting is a time-consuming technique that calls for being an affected person. The reason is that important facts for assumptions need to be accrued cautiously for the reliability of the forecast. All variables want to be clarified; as an example, expected coins needed for the destiny, profit, personnel wanted, and extra. In the case of uncertainty about these variables, assumptions must be made on enterprise history, or increase the revenue on predicted changes within the market. Forecasts of the destination state of the financial system are an important entry into the decision-making procedure. Once the forecast is finished, it ought to be revisited periodically. An up-to-date forecast can enable you to see if dreams from the past have come true or not. Formal paraphrase accurate forecast may be extraordinarily helpful, at the same time as making an incorrect forecast can result in high prices including more groups of workers or inventory.

Research has been performed and more of it is being performed to discover a more reliable and accurate method of monetary forecasting. The majority of this research’s focus is on theoretical studies, while the rest of the studies are on implemented technology, roughly forecasting. But this research nevertheless didn’t achieve the aim precisely. To continue to exist and compete with the commercial enterprise competitors in the marketplace and to fulfill consumer calls, it’s important that ports are managed and destiny planned carefully. It’s far more necessary to have the right statistics and song in the mildest of forecasts because it’s the most effective area that shareholders can control.

In today’s intensely competitive marketplace, agencies require more making plans. Companies will incur additional costs if they do not develop unique business plans. But a properly modeled forecast can defend the agencies against those unnecessary fees. Misguided forecasts additionally have an effect on the market’s reliability and on dating with 10 clients, suppliers, and partners. So the principal query that arises here is whether or not it’s possible to make correct forecasts continuously.

One of the boundaries in these studies became the potential of facts. The machine consists of thousands of variables. Some of these variables involve classified statistics, which are tough to gain from agencies as an observed case. The other difficult aspect is the scarcity of papers or other forms of resources on this one-of-a-kind subject. Forecasting and record mining are quite new in terms of the meaning of uncovered topics.

The tech marketplace is confusing because most products are made from components that can also be shopped for independently. Some customers want their entire enjoyment delivered to them in the most convenient way possible, and customers want to personalize their enjoyment with the best product or function for themselves in every aspect. This could make markets difficult to outline, and many clients could fall someplace in between.

Clients can also exchange their behavior based on the state of technology and different market forces; the computing device client marketplace affords an excellent example of this. For plenty of people, the laptop is the product. For a few, the product is each person’s element that they should purchase one after the other, primarily based on their desires and gathered at home. Those would possibly make up separate markets, but they might not. Even supposing they do, those markets can suddenly shift. Those tendencies of the tech industry make measuring opposition tough. With the aid of a few metrics, competition is poor. Through others, competition is powerful. Some tech companies are very different from one another, but they can compete fiercely in different service or product classes.

There is an additional hassle with writing huge technology off as an easy monopolist. Monopolists are commonly known for their laziness. It’s one of the key client’s harms antitrust legal guidelines are trying to find a way to defend against. Their high-quality drops, their accelerated upward push, and those who innovate far less. Is little or no motivation for an organization to develop and launch a new product when purchasers have no preference but to shop for their modern product? Perhaps the principal reason that massive tech appears so unbeatable is that they continue to compete based totally on the fear that they’ll be replaced identically, unseated other groups to get where they may be now. Whether actual or imagined, having agencies compete to live in the world in which they may be isn’t a terrible factor for customers, so long as they aren’t blocking off new corporations from getting their risk in an attempt to win the marketplace. The future direction of the region’s demand

Evidence-based conclusion on the bargaining strength of the supplier

When evaluating supplier power in a business, low supplier power creates a more appealing enterprise and increases profitability because customers are not constrained by providers. High supplier electricity creates a much less appealing enterprise and reduces profit capability, as consumers rely more heavily on providers. But the bargaining power of suppliers upon their own, does no longer determine the overall elegance of an industry. The remaining forces (bargaining energy of shoppers, contention among existing competition, the threat of new entrants, and the danger of substitutes) should be considered when figuring out general industry splendor.

Chapter three: methodology.

Lenovo’s assessment, comparison of overall performance with competitors

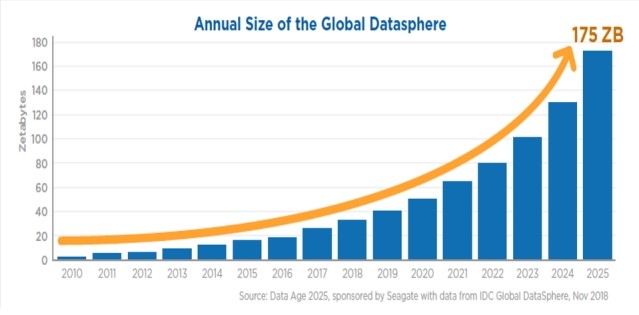

The enterprise is reworking with customers needing more sophisticated services, creating massive opportunities for industry services and controlled services, including the subscription-based as-a-service version. ICT infrastructure is the muse of digital and sensible transformation, with ICT infrastructure anticipated to be near the use of $250 billion in marketplaces through 2025. After investing in constructing a sturdy foundation, Lenovo is properly placed as a “complete-stack” ICT issuer.

Lenovo has had a great development in China, but the IBM acquisition has propelled the corporation to new heights. Before the deal, the agency had 10,000 employees who were the best in China at going for walks.

It now employs 27,000 people in three places around the world: Beijing, where yang is located; Hong Kong, where Wong and his finance employer exist and Lenovo is listed; and Mooresville, North Carolina, where Lenovo employs 6,000 employees in research and development, advertising, and sales. More than half of the group of workers with a vice president or higher position speaks Chinese, and the firm has adopted English as its specialist language.

In terms of Smartphone sales, Lenovo has a long way to go and a lot of ground to make up. According to IDC, the corporation is ranked ninth in the world, with 3.2 percent of the 155 million-device market. The majority of Lenovo’s profits come from China, where the business ranks second, clearly behind Samsung, with 11.2 percent of the market. Lenovo has purposely sacrificed profitability to focus on profit growth, according to Citigroup’s Chen, particularly in emerging markets computers and the Chinese mobile phone business.

As these agencies grow in size and value, he anticipates margins to rise. In the June 30 area, Chen estimates that Lenovo’s computer business in emerging markets approached breakeven, compared to a loss of over $100 million a year before, while Smartphone losses are running at a low rate of roughly $20 million 1 / four. In recent years, the manufacturing functionality of its establishments has severely exceeded, and this has led to a boom in market percentage, and the rating battle has emerged as worse. As a large PC producer in major cities, Lenovo has a task to mitigate the effect of the price conflict. But, Lenovo has come to be verified most vividly in this fee struggle. Lenovo did not reduce rates. While the organization picture stepped forward, earnings grew, and marketplace proportion progressed, the effective rate technique has enabled Lenovo to exceed in the economic gadget of immoderate potential.

Lenovo financial ratios evaluation in comparison to HP

Liquidity.

It has been given three ratios to measure the liquidity of every corporation, namely the contemporary ratio, the short ratio, and the strolling cash go with the flow ratio. In terms of present day-day ratio, which measures the strength to pay cutting-edge liabilities with contemporary assets, HP plays above Lenovo because Lenovo’s present day-day ratio is growing to be one within the next 4 years at the same time as HP’s current ratio is extended grade by grade, beginning from almost an equal feature as Lenovo’s in 2018.

Because Lenovo’s brief ratio decreased after 2019, at the same time as HP’s quick ratio improved step by step, thanks to the very fact that 2011. In terms of going for walks cash drift ratio, which measures how properly present-day liabilities are protected by using the use of the cash flow generated from an employer’s operations, HP no matter the truth that stands in the path of a better position, Lenovo’s going for walks cash drift ratio has deteriorated at an equivalent time as HP’s ratio increased from 2017 to 2020. In terms of features, HP has a higher feature set than Lenovo in terms of liquidity.

Insurance.

The property coverage ratio may be a check that determines an enterprise’s ability to cover debt duties with its assets inside the give-up liabilities is happy. Lenovo’s asset coverage ratio grew to become unstable over the last few suits. However, it has come to be no matter the very reality that loads better than HP. Typically, when I talk to Lenovo, I stand at some unspecified time in the future with a higher characteristic in terms of coverage functionality.

Exemplification

It has been given employed 5 ratios to stay on top of the running performance of each business. A business organization’s stock is bought and changed over some time, and an espresso turnover ratio, which might be an image of vain stock control, is usually dangerous for a corporation. However, the very fact that it produces sales. Each corporation’s asset turnover modified growth over the last 4 years. However, Lenovo performs a lot higher thanks to the very fact that its ratio has been nearly four times higher.

Debt receivable turnover shows the overall performance with which an employer manages the credit rating score it troubles customers and collects their credit rating. Lenovo’s money owed receivables turnover emerged as declining over the last few years, at the same time as HP’s ratio turned into enhancing. However, Lenovo emerged as even though higher in 2014, while its ratio emerged as 10. 90-in evaluation to HP’s ratio of five. Forty-two. In other words, Lenovo must obtain credit rating cases as quickly as HP.

Debts payable turnover is a short-term liquidity metric used to calculate the value at which a corporation can pay off its vendors, and lower bill payable turnover is usually better for the employer. According to the data, HP increased its pay-lower again period for carriers from 78 days in 2011 to 103 days in 2014, while Lenovo cut its pay-lower again period for businesses from 50 days in 2011 to 44 days in 2014.

A measure measuring the depletion of capital to the level of earnings over a certain period is known as net capital turnover. Given Lenovo’s poor ratio, it’s more than likely that the net walking capital was successfully implemented to generate profits. According to the falling ratio from 2011 to 2014, HP’s ability to generate money from net walking capital has decreased. Overall, Lenovo is expected to perform better based on walking standard performance in the future due to its strong ability to generate sales from online walking capital and belongings, excellent inventory management, and stronger credit score rating rating-amassing capability.

Earnings potential

It looked at both groups’ profitability using three ratios: earnings margin, pass returned on conventional fairness and move lower back on asset. The profit margin is a crucial metric of profitability since it determines what percentage of each dollar of revenue an organization keeps in profit. Lenovo’s profit margin has gradually increased from 1.3 percent to two.1 percent, whilst HP’s profit margin has become riskier. During the lucrative years, however, HP’s profit margin was larger than that of Lenovo.

Commonplace fairness is a metric that analyzes how much profit a company earns with the money invested by its owners. Lenovo’s ROE nearly doubled from 2015 to 2020, whereas HP’s ROE became unsteady and remained below the amount of Lenovo’s. Return on assets measures how efficient a company’s assets are in generating profits.

During the one’s lucrative years, HP’s ROA was higher than Lenovo’s. However, Lenovo’s ROA finds itself expanding steadily at the same rate as HP’s ROA isn’t always in the opposite function, and in 2014, Lenovo had virtually equaled HP’s ROA. Lenovo has higher profitability in terms of generating earnings from invested capital assets on average, but HP has a higher charge control, which is critical to a higher earnings margin. Estimates of future financial trends that are of high quality

Past signs and symptoms

When estimating for the long term, the most important consideration is past commonplace performance. If you’ve been given the decision within the beyond that its earnings tend to be seasonal, use those annual fluctuations to assist calculate predicted outcomes. As soon as you have placed that profits boom via a particular percentage at the same time as you run a purchase, use those statistics at the same time as you calculate the sales you could generate through destiny income. Preserve notable records and be on the lookout for recommendations from them, even when making forecasts. Have an observer beyond forecasts with real consequences to investigate instructions about enhancing their assumptions.

Variables

Be aware of as many variables as feasible that have an impact on its estimates. If you promote a product that customers use inappropriate ways instead, plan for improved earnings in the spring. However, be conscious that spring as a substitute is not well. Study its opposition to find out about the strategies that affect its sales. Although you cannot anticipate an equivalent time as they’ll be introducing a product that without delay competes on the side of its very private, you’ll be able to figure out a rhythm or sample of their behavior, collectively with their normally introducing new products in the spring.

Operating with uncertainty

Make its predictions more flexible. However, the very reality that you simply might not recognize exactly what the climate is often like in a few unspecified periods in advance of the imminent spring means that you may not have a sense of the degree to which it will affect its profits. Select certainties and assemble predictions around them. For instance, you will no longer recognize whether or not its business corporation will promote $6,000 or $7,000 worth of products in the case of the upcoming month, but you’ll be in a position to mention with the greater incontrovertible fact that its substances fees will run about 33 cents of its income, a few aspects.

Estimations

Estimating for the future typically becomes smoother over time, and predictions become more accurate. The longer you stay in a business or commercial organization, the more experience you will gain at seeing the massive photographs and factoring in variables that may not have come to you early on. Use the information you have obtained with time.

Lenovo financial forecasting and analysis

Forecasting is primary to monetary and monetary decision-making. Authority establishments and agents in the government zone frequently base their selections on forecasts of financial and financial variables. Forecasting has therefore been a number one situation for practitioners and monetary econometricians alike, and the relevant literature has witnessed a renaissance in the latest years. This thesis contributes to this literature by way of investigating three topical problems associated with economic and financial forecasting. Forecasts are required for two fundamental reasons: destiny is uncertain, and the total effect of many selections taken now isn’t always felt until later. Therefore, correct predictions of the future improve the efficiency of the selection-making method. Formalized paraphrase monetary forecasting is one of the essential elements of control. Understanding or having a near estimation of the company’s financial scenario over the coming time will help the firm to revise its business choices and strategy for the future.

Financial forecasting is a time-consuming technique that calls for being an affected person. The reason is that important facts for assumptions need to be accrued cautiously for the reliability of the forecast. All variables want to be clarified; as an example, expected coins needed for the destiny, profit, personnel wanted, and extra. In the case of uncertainty about these variables, assumptions must be made on enterprise history, or increase the revenue on predicted changes within the market. Forecasts of the destination state of the financial system are an important entry into the decision-making procedure. Once the forecast is finished, it ought to be revisited periodically. An up-to-date forecast can enable you to see if dreams from the past have come true or not. Formal paraphrase accurate forecast may be extraordinarily helpful, at the same time as making an incorrect forecast can result in high prices including more groups of workers or inventory.

Research has been performed and more of it is being performed to discover a more reliable and accurate method of monetary forecasting. The majority of this research’s focus is on theoretical studies, while the rest of the studies are on implemented technology, roughly forecasting. But this research nevertheless didn’t achieve the aim precisely. To continue to exist and compete with the commercial enterprise competitors in the marketplace and to fulfill consumer calls, it’s important that ports are managed and destiny planned carefully. It’s far more necessary to have the right statistics and song in the mildest of forecasts because it’s the most effective area that shareholders can control.

In today’s intensely competitive marketplace, agencies require more making plans. Companies will incur additional costs if they do not develop unique business plans. But a properly modeled forecast can defend the agencies against those unnecessary fees. Misguided forecasts additionally have an effect on the market’s reliability and on dating with 10 clients, suppliers, and partners. So the principal query that arises here is whether or not it’s possible to make correct forecasts continuously.

One of the boundaries in these studies became the potential of facts. The machine consists of thousands of variables. Some of these variables involve classified statistics, which are tough to gain from agencies as an observed case. The other difficult aspect is the scarcity of papers or other forms of resources on this one-of-a-kind subject. Forecasting and record mining are quite new in terms of the meaning of uncovered topics.

Forecast analysis of the Lenovo enterprise has been considered. This is stitched from the Yahoo Finance page for the period overlaying March 2021 to February 2025. Because the point of interest is a threat to the technology sector, the open positions of the sector’s performance are extracted. The forecasted economic statements are attached inside the accompanied Excel file.

Recommendations and Conclusion

In this examination, the problem of financial hazard control has been evaluated with a unique emphasis on the world market. The use of the monetary marketplace has been criticized for not attending to the authentic ethics of coping with monetary risks. As an example, even though the use of space had sustained an increase in the past, it has additionally been revealed that the arena has suffered a primary setback. The most important reason for the state of affairs is posited to be the reality that the arena’s inner management suffers from an intense stage of inefficiency and exposure to moral risk orchestrated by political maneuvers as posited with the aid of Pascha (2010). Furthermore, the government’s constant intervention in the country’s economic sector has prevented the power of the market subject; there was persistent interference in the financial area, resulting in an inefficient and distorted financial system (wang, 2006). Moreover, economic establishments’ initiative and force for innovation have been constrained by the financial industry’s undue segmentation as well as excessive access limitations. Additionally, widespread government participation and interference inside the internal control operations of financial institutions have undermined their autonomy and hampered their duty, thereby making the machine’s supervisory attempts ineffective and permitting immoderate threat-taking through the financial establishments. Meanwhile, the next pressure by the government to overhaul the monetary quarter to be market-oriented has dashed the rock due to political obstacles and confined scope to remove the inimical distortions deeply rooted in the financial quarter (Pascha, 2010). Furthermore, the absence of proper prudential supervision has assured moral chance in the monetary quarter and ensured non-stop problems in the pursuit of ability in monetary risk management. Therefore, in reaction to the question raised earlier, one cannot but consider the fact that economic change control should be inquisitive about all its seriousness due to its lousy effects.

Research and improvement of the latest understanding technology. within the context of a business, it is business drawings to create new products, strategies or offers, or to improve current ones. To do this, companies often put themselves at risk. This is because uncertainty is all around us when what they want to achieve happens technologically, or, more commonly, they now see no way to honestly achieve their goals.

R&D is an important business for many companies. The advent of the latest services or current improvements is a way for a business to maintain competition and make a profit.

while developing a brand new product, method or service, or refining current, R&D is one of the first degrees. Innovation is not uncommon at this level, in addition to risks. The R&D cycle often begins with ideas and ideas, accompanied by studies and observations and then produced and created.

Wonderfully trained staff

Equipping employees with the necessary modern skills and job opportunities to create jobs is a positive aspect of the organisation’s vision and development of all businesses within the sector. Collectively, governance should promise to assist in strong training strategies to address the challenges of promoting strong, sustainable and equitable resilience in each department and within the organization as a whole. New jobs are growing and are being replaced. within all businesses, important skills and competencies emerge, as the content of understanding of production strategies and services will grow. The main task of the Blue Ocean at the same time is to increase the responsiveness of school and learning packages to those skills needs and to improve access to education and skills development. the training gained is widely used over time, the success of all organizations depends on how many of its employees see and how well they work, depending on their living environment and the effectiveness of that skill. skills promotion of first level work.

The survey of the literature indicates that there exist several possibilities for similar development in data mining. However, not all the areas are being studied by researchers. Using statistics mining and Monte Carlo, we provide a plethora of exciting fashions and outcomes to enhance predictions. The results of the Moffat & Nichol case study propose that data mining strategies can be useful to achieve hidden relationships among variables, and applying numerous strategies to the same facts can prevent misunderstanding of models. The gain of making use of more than one statistical mining technique in the result is that it forces the analyst to position all the elements in a good way to alter the forecast, but relationships do not mean anything if they are not confident. The tool, if it is, likewise, assessing the strength of that cost with root-relative square errors, which is a great indicator of forecasting model quality.

Lenovo’s lengthy-term improvement is inseparable from a unified and correct guiding ideology. Only with the proper lengthy-time period strategic making plans for the manual, using its characteristics with humans in the organization control approach for the management of Lenovo, could Lenovo be able to establish a sound management device so that you can manually guide the enterprise to solid, healthy, and rapid improvement. Lenovo’s development method-making plans are based on external evaluation, in opposition to Lenovo’s real work, introducing the whole improvement desires in line with the target corporation’s level, commercial enterprise layer, and features layer development strategy. Under the general taking into account improvement approach, it ought to develop a sequence of feasible, precise strategies.

REFERENCES

https://www.macrotrends.net/stocks/charts/LNVGY/lenovo-group/income-statement

https://investor.lenovo.com/en/news/corpnews.php

Allen, L., Boudoukh, J., and Saunders, A. (2019): “Understanding Market, Credit and Operational Risk – the Value at Risk Approach”. Blackwell Publishing Ltd

Aziz, Z. A. (2018): “Basel II Implementation and the development of Asia’s Financial System – Experiences, Challenges and Regional Coorperation”. A Keynote Address at the 4 th SEACEN/ABAC/ABA/PECC Public-Private Dialogue for the Asia Pacific Region, Kuala Lumpur, 18 August 2018; available online at: http://www.bis.org/review/r080819a.pdf?frames=0

Charles, T. (2017): “Risk and Financial Management: Mathematical and Computational Methods”. John Wiley & Son

Crockford, N. (2016): “An Introduction to Risk Management (2nd Ed.)”. WoodheadFaulkner

Dickey, D.A. and Fuller, W. A. (2019): “Distribution of the Estimators for Autoregressive Time Series with a Unit Root”. Journal of the American Statistical Association, 74: 427–431

Duffie, D. and Pan, J. (2017): “An overview of value at risk”. Journal of Derivatives, 4, 7-49

Fama, E. F. (2020): “The Behavior of Stock Market Prices”. Journal of Business, 38, 34-105

FCIC (2020): “The Financial Crisis Inquiry Report Authorized Edition: Final Report of the National Commission on the Causes of the Financial and Economic Crisis in the United States”. US Public Affairs

Glasserman, P., Heidelberger, P. and Shahabuddin, P. (2019): “Portfolio Value-AtRisk with Heavy-Tailed Risk Factors”. Mathematical Finance, 12(3), 239-269

Data Source: Yahoo! finance: http://uk.finance.yahoo.com/q?s=^KS11&ql=0

Burke, Rory, 2013. Project management: planning and control techniques. New Jersey, USA, 26.

Hillson, D., 2003. Using a risk breakdown structure in project management. Journal of Facilities management, 2(1), pp.85-97.

Muneeb, M. and Jadhav, D., 2020. Project Report | Meaning | Contents of A Finance Report. Account learning.com. .

Radujković, M. and Sjekavica, M., 2017. Finance management success factors. Technology industry, 196, pp.607-615.

Cavalieri, D. (2017). Towards an integrated theory of value, capital and money. Towards an Integrated Theory of Value, Capital and Money, 123-138.

Flaschel, P. (2003). 6 Disequilibrium growth in technology economies. Cycles, Growth and Structural Change, 128.

Krolzig, H. M. (2006). Comparirison macroeconomic stability in tech industry: basic structural form, estimation and analysis. Contributions to Economic Analysis, 277, 7-47.

Boughton. (2018). Strategically Marketing. Renmin of China University Press. Chen, Y. J. (2016). Global brand’s marketing communication research – a case study of Lenovo PC,

master’s thesis, Graduate institute of communication, Shih Hsin University, Taiwan. Dollar, D. (2020). The financial structure of the enterprise. Journal of the accounting and financial,

1(10), Gan, Huaming. (2017). Business strategy. Beijing international press, p27.

Jack·Telaote·Lise, (2006). Positioning. the Financial and Economic Publishing House. Keller, K. L. (2018). Conceptualizing, Measuring, and Managing Customer-Based Brand Equity.

Journal of Marketing, 57(January), 1-22. Miles, R. E. and Snow C. C. (2020). Organization

Strategy, Structure and Process, New York: McGraw-Hill. Porter M. (2018). Competitive

Strategy, Simon& Schuster Press Yang, Y. G. (2016). The product strategy of the Lenovo, Economy Journal, 8(1),

Chao, Loretta; Fletcher, Owen (30 November 2019). “Lenovo Sets Web-Linked TV”. The Wall Street Journal.