Essay on Banco De La Nacion

Number of words: 1867

Table of Contents

| Argentina: Country Overview | 2 |

| Financial Services System | 3 |

| Central Bank and Its Roles | 4 |

| Capital Markets | 5 |

| Banco De La Nacion Financial Information | 6 |

| Discussion | 7 |

| References | 7 |

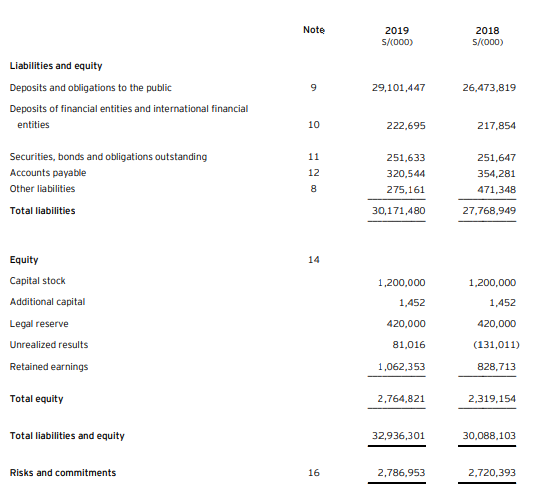

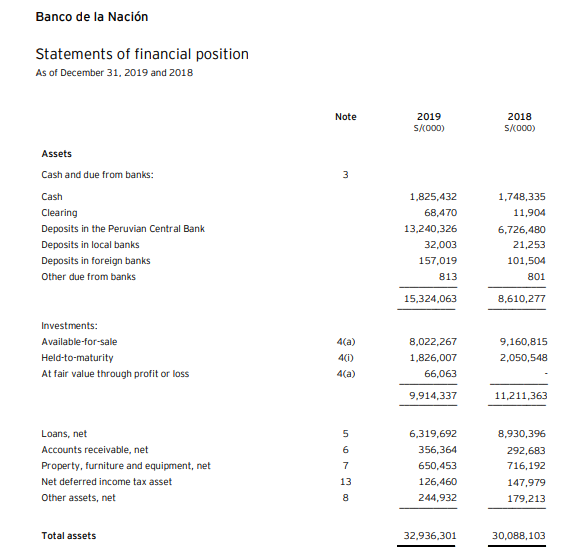

| Appendix 1: Statement of Financial Position | 9 |

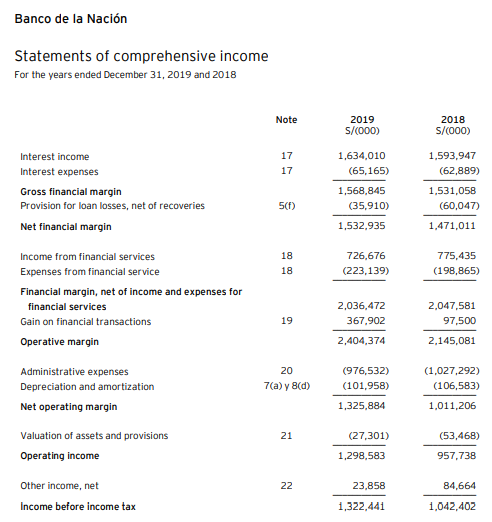

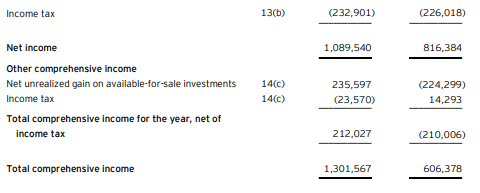

| Appendix 2: Statement of Comprehensive Income | 11 |

Argentina: Country Overview

Generally, Argentina is a country of flat plains, jungles, and high mountains. The land making up today’s Argentina was initially inhabited by native tribes. In 1810, the first independent government was established. However, fierce domestic conflicts arose in 1820 between various political groups. Argentina’s political climate has been tensed due to conflicts between Federalists and Unitarians. In terms of economy, the country has rich natural resources and a major contributor to the economy is the agricultural sector. Argentina is a major beef producer whereby most is exported to the US. Argentina has seen major economic downturns with periods of high inflation, increasing external debt, fiscal and current account deficits. Such crises led to slow growth in the manufacturing sector resulting in increasing income gaps and poverty (Halevi, 2016). Severe depression and rising external and public debt have had adverse impacts on the political, social, and economic crisis. With the recent global economic crisis, the country has been strong; however, the government’s sustained push for expansionary fiscal and monetary policies is rising the already extreme inflation levels.

Financial Services System

In Argentina, the financial crisis began in the 80s with the failure of Banco de Intercambio Regional which was Argentina’s main private bank. 68 financial institutions and banks had failed by 1982 among them including Banco International, Banco Oddone, and Banco de Los Andes. Argentina’s banking sector has undergone different shifts since the Tequila crisis (Dutto Giolongo, 2016). Such changes include growth in foreign institutions entry, privatization, substantial consolidation, and tightened supervision and regulation. The financial system experienced fast expansion during the restructuring process and various financial entities were down by over 30%. Different policies like treating foreign capital like domestic capital, or continued diversified entry for foreign banks have strengthened the financial system further. Foreign banks in Argentina are large relative to domestic banks. Besides, they are growing rapidly with a substantial portfolio.

The central bank regulates the financial services system and established prudential regulations that focus on systematic facing the sector. The regulations are market-oriented and strive to complement the banking system oversight responsibilities through rating agencies, auditors, and investors (Dutto Giolongo, 2016).. The overall banking structure appears sound and integrates most contemporary global best practices. Central Bank of Argentina attempts to strengthen banking supervision and regulate the operations of the financial system. Generally, the financial system comprises a complex institutional framework whereby the monopolistic supplier of high-powered money is the central bank. Non-financial institutions and banks are seen as intermediaries between lenders, savers, and the security market. Such institutions make up the official financial market. The central bank controls money and credit expansion by determining lending and deposit rates and also reserve ratios. Presently, many state-owned banks dominate the country’s banking sector with the largest one being Banco de la Nacion.

Central Bank and Its Roles

The Central Bank of the Argentine Republic is the autarchic entity in the country established by six Acts of Congress. It replaced the country’s currency board and played a significant role during the Latin American debt crisis. The central bank enacted Circular 1050 in 1980 intended to safeguard the financial sector from costs related to receiving payments after the sudden devaluation of pesos (Damill, Frenkel, & Simpson, 2016). Financial system in Argentine entailed various currencies issued by foreign and domestic banks. Currency convertibility lasted for short period in a situation referred to as “stop-gap currencies.” Poor centralized authority to manage currencies brought instabilities in the financial system. From 1890 to 1891 outburst, various institutions such as Banco de la Nacion and Caja de Conversion were established which concentrated in instruments management, roles designed for the central bank. However, such efforts were not adequate as financial and monetary instabilities were overwhelming due to poor coordination and balance of payment fluctuations from Argentina’s commodity-based economy and unstable capital movements (Damill et al., 2016). Different bills were presented to Congress together with the objective of establishing an entity that could arrange and monitor the monetary and banking system. After the 1929 financial crisis which led to the collapse of the country’s financial system, the country was adversely affected by trade partners’ protectionist policies and a significant decline in capital inflows. Dramatic effects on the financial system led to the creation of the Central Bank to control foreign exchange and monetary policies.

The Central Bank has various powers and functions which include regulation of financial system operations and enforcing laws related to a financial institution like regulations. It regulates interest rates and money supply and steer and monitor lending activities. The Central Bank is the government’s financial agent, acting as an agent and depository for the country before international monetary, financial, and banking institutions are endorsed by the country. The banks also play a key role in international cooperation and integration. Other functions include holding and administering foreign exchange reserves, gold, and other foreign assets. It supports the smooth working of capital markets as well as implementing foreign exchange policies (Cherny, 2015). Furthermore, the Central Bank regulates all payment systems, cash-in-transit entities, money remittance companies, and clearing and settlement houses.

Capital Markets

The capital markets in Argentina have developed recently although the banking sector is still ahead of capital markets. In addition, trade volumes and market capitalization lag behind levels reached in developing nations (Gonçalves et al., 2019). However, possibilities of growth in capital markets are still high majorly due to the quick institutional investors’ evolution, which could be the only chance for capital markets development. In the country’s equity market, both trading activity and market capitalization are concentrated in large corporations. Such corporations are still the ones that trade ADRs in New York (Gonçalves et al., 2019). Further, their trading activities are significantly larger than what is seen in Buenos Aires. The number of listed entities declined but there has been a growth in the volume of outstanding stocks. The trend resulted in the intensification of Argentina’s equity market.

There has been a noticeable growth in the bond market in which the dominant role is played by the public sector. The private sector has also begun increasing its absolute role as opposed to previous years. Besides, other new sectors commenced issuing bonds. In the country’s financial system, institutional investors are a significant emerging force. Mutual funds, insurance companies, and pension funds collectively contribute to over 7% of gross domestic product. The change is essential and reflects well for the financial system structure and shows reforms in the regulatory and legal environment and stabilized macroeconomic conditions. The insurance sector lags behind the modernization and growth of other institutional investors. Major issues in the insurance industry include the establishment of an insurance information bureau, the institution of a rating system, and consolidation through closures and mergers. Regardless of such issues, insurance companies are likely to be significant pension beneficiaries, reforms, and continued economic recovery.

Banco De La Nacion Financial Information

ROA = net income / total assets (Currency, Peso)

2019: = $1,089,540 / $32,936,301 = 3.31%

2018: = $816,384 / $30,088,103 = 2.71%

ROE = net income / shareholders’ equity

2019: = $1,089,540 / $2,764,821 = 39.42%

2018: = $816,384 / $2,319,154 = 35.20%

Equity Multiplier (EM) = total assets / total shareholder’s equity

2019: = $32,936,301 / $2,764,821 = 11.9

2018: = $30,088,103 / $2,319,154 = 13.0

Debt to equity ratio: = total liabilities / stockholders’ equity

2019: = $30,171,480 / $2,764,821 = 10.91

2018: = $27,768,949 / $2,319,154 = 11.97

Discussion

Banco De La Nacion’s available and latest financial statements indicate an increase in ROA from 2018 to 2019. This implies the bank is striving to increase income from the assets it controls. An increase in ROE in 2019 also suggests the bank can increase its income without requiring much capital. It shows Banco De La Nacion is effectively utilizing its shareholder’s capital. In 2018, EM was high implying the bank had a higher level of leverage. However, in 2019, EM declined to 11.9 meaning the debt component is decreasing and Banco De La Nacion does not rely heavily on leverage. This is also evident in the debt-to-equity ratio which decreased in 2019 and indicates the bank is mainly financed by investors or shareholders as opposed to creditors or bank loans. In conclusion, Banco De La Nacion is showing improvement in performance and less utilization of debt components. As a result, the bank has a high potential of maintaining robustness in the financial markets.

References

Cherny, N. (2015). Institutions, credibility and crisis: the inconsistencies of Argentine exchange rate policy (1991-2006). Brazilian Journal of Political Economy, 35(1), 95-113.

Damill, M., Frenkel, R., & Simpson, L. (2016). An unlikely Phoenix: The recovery of Argentina’s monetary and financial system from its ashes in the 2000s and its lessons. Journal of Post Keynesian Economics, 39(2), 228-255.

Dutto Giolongo, M. (2016). The Argentine Financial System. Main Features and Recent Trends. Deutsch-Argentinische Wirtschaftsstudien/Estudios Económicos Argentino-Alemanes, Forthcoming.

Gonçalves, B. A., Carpi, L., Rosso, O. A., Ravetti, M. G., & Atman, A. P. F. (2019). Quantifying instabilities in financial markets. Physica A: Statistical Mechanics and its Applications, 525, 606-615.

Halevi, J. (2016). The Argentine Crisis. In Post-Keynesian Essays from Down Under Volume II: Essays on Policy and Applied Economics (pp. 397-404). Palgrave Macmillan, London.

Appendix 1: Statement of Financial Position

Appendix 2: Statement of Comprehensive Income