Essay on Canadian Recession 2020

Number of words: 1859

The contemporary world is heading to an economic crisis following the colossal impact the coronavirus pandemic has brought up. More and more cases are being discovered daily, and governments continue to issue lockdown directives. This implies that fewer people are working, which puts the economy at stake. In many countries, civil servants have been directed to stay at home, thereby risking the economy for healthy living. The global economy is predicted to go into recession. Reports state that during the month of March, the unemployment rate was steadily increasing as the COVID-19 pandemic took a toll in Canada. During this time, many enterprises were overwhelmed with fear and began to close businesses, shutting doors to staff. Following this directive, companies laid off many workers leaving behind only crucial staff for the sake of company continuity (Staff & Wires, 2020). As a result, the Canadian economy has incurred a record of over 1 million job losses in March.

Many economic sectors in Canada have been affected. Among such sectors is the agricultural sector, where farmers are incurring huge losses. According to financial reports, dairy farmers have been spotted dumping millions of liters of milk following the COVID-19 pandemic. This is due to the closure of bulk buyers such as restaurants, schools as well as hotels due to the federal directives. Not long ago, the Dairy Farms of Ontario has requested farmers to consider massive production in fear of shortages, but now more than 500 farms had to dump their many liters of milk (BBC News, 2020). Furthermore, other sectors such as the oil industry are experiencing losses too due to banned travel hence less demand. Following the disagreements between Saudi Arabia and Russia on the price war, the Canadian industry-oil has also been affected. Such less demand for products is a key indicator of a recession.

The supply and demand of products define an economy. The higher the demand, consequently influences the supply meaning more production, and in the long run, more labor force is needed. Therefore, the higher the demand translates to, the higher the employment rate. However, based on aggregate demand, one of the main factors causing a shift in an AD curve is the changes in exchange rates. At this point, many countries are experiencing huge drops in the exchange rate. The economic value is declining, which comes as a result of the closure of major industries. At this point, companies and factories have been shut down as a preventive measure for the coronavirus. However, the demand for products such as oil has declined, thereby influencing the exchange value in the economy. This results from low prices of goods due to less demand and hence a decrease in the economic value.

Furthermore, the supply of goods in the market has been greatly affected. Following the directives given by the federal government regarding staying at home, many companies have experienced a loss of labor. In supply, labor is crucial in the strive to feed and satisfy the growing population. Nowadays, the population of Canada is growing steadily and hence the need for more labor. However, during the coronavirus pandemic, many people have been forced to stay at home in fear of the deadly disease. Despite the federal government giving orders to stay home, many people logically wild choose to stay home for the sake of their health rather than risking the fatalities of the COVID-19 pandemic. Nevertheless, the less demand resulted in less the aggregate supply hence the substantial job losses in Canada. According to statics by Force Survey data, the march unemployment rate surpassed the 1976 unemployment era (Staff & Wires, 2020). Now economists are trying to revise the projections made for the year 2020 as the pandemic drives many economies to a recession.

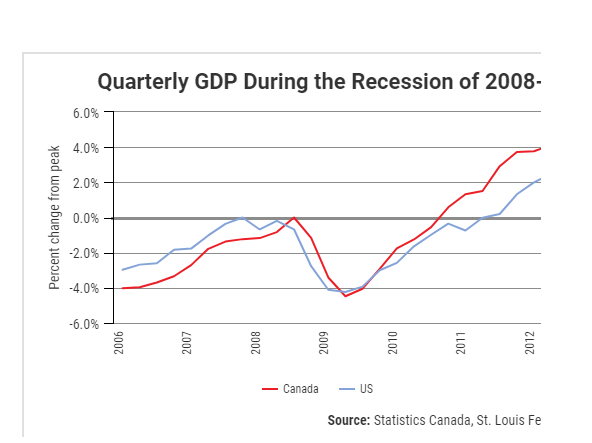

Over the past years, just like in other countries, Canada has faced economic recessions. In several cases of recession experienced in Canada, such recessions were also experienced in the United States of America. These two bordering countries have affected the economy of each other for a while. Canada is very sensitive to its principal activities, such as oil and gas, mining, and lumber. For instance, the 9/11 attacks on the US affected the stock market of both the United States and Canada (Gordon, 2017). The US experienced considerable losses in the financial market as a result of housing lending, and many people were defaulting payments. This hugely affected more but spread to Canada. Canada, over the years, has been able to rise from the recessions and maintain the rise in employment and hence the economy. However, for the 2008-2009 crisis, it was attributed to the housing market issues experienced by financial organizations. The housing issues originated from the US and spread to Canada, where many people have colossal housing debts, and hence the demand for other commodities such as oil declined (Sorensen & Hutchins, 2015). Over the years, the economic graph has been W-shaped. Below is a V-shaped graph showing the recent 2008 recession effect.

(Gordon, 2017)

Oil prices began to decline in the early months of 2008, and with time the financial market began to struggle. The decline in export commodities amounted to a surge in the economy. Based on the sensitivity of oil and gas in Canada, the country is making losses as the global market is decreasing (Gordon, 2017). The coronavirus pandemic has led to the cancellation of the many international flights as well as local movements within the country. This is an indicator that oil is among the major contributors to the economy, is losing its demand. Besides, many businesses have closed, thereby affecting suppliers like the farmers who now incur losses. The demand level of major commodities that drive the economy has declined from March and hence the high unemployment rate and thus the economic surge. In the past recessions, Canada has been affected by recessions from the US, but following the COVID-19 pandemic effect on each country, the 2020 recession is likely to be severe than previous recessions. The impacts are direct from within the country but not from the US and hence the predicted massive economic surge.

In the previous recessions, Canada has been able to emerge and regain economic stability. In this COVID-19 era, Canada is expected to rise above the crisis to minimize the impact. Following the 2008 recession, the government, through the Bank of Canada, was able to restore the financial imbalances as a result of household debt. Similarly, the demand level of some major commodities is low, and therefore through the Bank of Canada, the Canadian government drafted monetary policies and fiscal policies. The current government aimed at cutting taxes and encouraging spending to overshadow the economic difficulties, but the outbreak of the coronavirus is challenging this draft (The Conference Board of Canada, 2020). Even though the stretch of the coronavirus pandemic is yet to be determined, federal Bank of Canada, in correlation with local banks have in the past conquered recession through reduced interest rates. This is characterized by the monetary policy defined by the Bank of Canada. The rates imposed on goods and services once reduced would result in massive spending and hence a rise in demand.

However, the COVID-19 pandemic is proving to be fierce; the much-expected spending is not an option. Therefore, the Canadian government is considering the fiscal policy as other count rues have done or planning to do. The effects are unpredictable as more money is being pumped into the health sector to minimize the fatalities. Interest rates currently are too low, but still, they are proving ineffective in supporting the economy. Following the enormous fiscal arsenal of Canada, a relatively lower debt in relation to the GDP ratio has been realized, and hence fiscal measures can be implemented. Countries like the United States, through the federal reserve, announced to avail US$1.5 trillion to handle the disruptions caused by the coronavirus pandemic (Editorials, 2020). In this regard, Ottawa announced a financial aid of $27million, which would address issues predicted to affect housing and businesses (Alini, 2020). Business advocates continue to urge for more pay to Canadians as they work from home during this corona crisis. The unemployment rate is escalating and hence the need to preserve the labor force by taking fiscal measures.

The COVID-19 pandemic has affected more than just international travel. Exports and imports have been concerned with many countries now holding their medical commodities and food to themselves as they try to carter for the hailing population. However, Canada has among the major oil reserves around the globe, thereby gaining comparative advantage in the global economy. Oil is a significant input in many industries, and therefore Canada produces at lower opportunity costs without much relying on the external markets. Essential commodities are readily available as a result of oil inputs. This is a stronghold in preventing huge impacts of the predicted 2020 recession.

The current economic state of many countries is dropping steadily. The money value is declining, and less demand for high-value commodities is low. The ban on international travel has also affected imports and exports in the global market. The local market has also declined. Canada, in the past measure, encouraged massive spending, but following the millions of unemployed Canadians, the expenditure is not quite realizable. Therefore, there is less currency flowing into the market, and hence the money value is declining. Exchange rates are falling, and consequently, the balance of payment is declining. Even though the government, through the Bank of Canada, has implemented measures to address the economic disruptions, it seems not enough as many lose jobs, and more funding is directed to health. In this regard, the 2020 recession may be inevitable if the COVID-19 pandemic persists.

References

Alini, E. (2020). Coronavirus: Is Ottawa doing enough to save the economy? Global News. Retrieved 9 April 2020, from https://globalnews.ca/news/6717639/coronavirus-ottawa-save-the-economy-depression/.

BBC News. (2020). Covid brings tears and spilt milk to Canadian dairy. BBC News. Retrieved 9 April 2020, from https://www.bbc.com/news/world-us-canada-52192190.

Editorials. (2020). Globe editorial: If Canada falls into a coronavirus recession, Ottawa has the fiscal firepower to get us out. The Globe and Mail. Retrieved 9 April 2020, from https://www.theglobeandmail.com/opinion/editorials/article-if-canada-falls-into-a-coronavirus-recession-ottawa-has-the-fiscal/.

Gordon, S. (2017). Recession of 2008–09 in Canada | The Canadian Encyclopedia. Thecanadianencyclopedia.ca. Retrieved 9 April 2020, from https://www.thecanadianencyclopedia.ca/en/article/recession-of-200809-in-canada.

Sorensen, C., & Hutchins, A. (2015). How Canada’s economy went from boom to recession so fast. Macleans.ca. Retrieved 9 April 2020, from https://www.macleans.ca/economy/economicanalysis/how-canadas-economy-went-from-boom-to-recession-so-fast/.

The Conference Board of Canada. (2020). Canadian economy to avoid recession in 2020: Conference Board of Canada. Conferenceboard.ca. Retrieved 9 April 2020, from https://www.conferenceboard.ca/press/newsrelease/2019/12/17/canadian-economy-to-avoid-recession-in-2020-conference-board-of-canada.

Staff & Wires. (2020). The latest on the coronavirus: Jump in prison cases; Ontario death toll up to 200. The Globe and Mail. Retrieved 9 April 2020, from https://www.theglobeandmail.com/canada/article-the-latest-on-the-coronavirus-ottawa-to-reveal-grim-jobless-rate/.