Financial Insights and Business Challenge

Number of words: 2075

Introduction

Fort Jesus, Mombasa, is one of the UNESCO world heritage centres and is located in Kenya. It was built in the late 16th century (1593-1596) on the Kenyan coastline (Sarmento, 2010). At the time, Mombasa was a critical transit place for trade and was the gateway to India and the Middle East. The Portuguese primarily built Fort Jesus to protect the town of Mombasa from outside invasion (Pikirayi & Schmidt, 2016). Currently, Fort Jesus is one of the most visited places in Mombasa. Fort Jesus has several historical significances. First, it serves to remind us that at some point, the Portuguese ruled all the trade routes in the Indian Ocean (Rogerson, 2012; Waugh, 2012; Timothy, 2011). Secondly, it reminds us of how the slaves from the East African region suffered from hunger, torture, and disease(Rogerson, 2012; Waugh, 2012; Timothy, 2011). Normally, Slaves would be held at the port as they waited to be transported to the Persian and Arabian Gulf (Kihima & Ariya, 2020). Although the Fort was built according to the designs of Italian architect Giovanni Battista Cairati, the local Swahili people provided all the labor and building material (Kihima & Ariya, 2020). Fort Jesus became a UNESCO world heritage site in 2011.

Business Proposal

Although Fort Jesus continually attracts tourists every year, its potential as a world heritage site has not been fulfilled. Fort Jesus is currently operated as a museum. Visitors to Fort Jesus are normally shown historical artifacts excavated from Fort Jesus, Gede Ruins, Manda, and Ungwana (Timothy & Boyd, 2015). In this regard, Fort Jesus’s history as the place where slaves were held awaiting transportation to the Arabian and Persian Gulf often goes uncaptured (Timothy & Boyd, 2015; Mahoney, 2012). Besides, Fort Jesus’s history as the place where different cultures such as the Portuguese, Arab, British, and Swahili often goes unnoticed.

Recent tourism trends have shown that contemporary tourists prefer experiences. Most of the contemporary tourists do not want to go for sightseeing; they want to be involved (Cohen, 2012). In this regard, there is a need to rebrand Fort Jesus as a cultural and heritage center. Arguably, a cultural and heritage center will attract more revenue when compared to a museum (Cohen, 2012; Timothy, 2014). Conceivably, this is because a cultural and heritage center provides tourists with experience. Most tourists are always ready to pay premium prices for meaningful experiences.

As a cultural and heritage center, visitors to Fort Jesus will be allowed to gain an intimate understanding of its history. By making Fort Jesus a cultural and heritage center, this will provide the local community with an opportunity to be increasingly involved in its operations (Sharpley, 2011). Currently, the National Museums of Kenya is the only entity that administers Fort Jesus. While this has resulted in increased efficiency in running the site, it has also led to the local community’s alienation. Subsequently, this has adverse effects on the visitors as it impedes the quality of experience. In particular, it makes it increasingly challenging for visitors to understand the social and political history of Fort Jesus fully.

For the cultural and heritage centers, some members of the local community will be selected. The selected members will serve as hosts and guides to the visitors. In addition to the museum visit fees, the visits will have to pay for host fees. Some fraction of the host fees will be sent to the hosts, while the site will retain some renovation. This business model’s significance is that it will result in an improved and meaningful experience for the visitors while also economic and financial benefits for the local community (Page & Connell, 2020).

Revenue Generation Model

Under the proposed business model, the main source of revenue for Fort Jesus will be ticket and host fees. However, some revenues will be garnered from the sale of merchandise, strategic partnerships with hotels, photos, and video shoots, rent from restaurants and shops, and income from advertisement. Visitors who pay for ticket fees only will only be taken through a visit to Fort Jesus. Visitors who pay for host fees will be assigned localhost to take them around Fort Jesus and the local surrounding. Besides, visitors who pay for host fees will be provided an opportunity to interact and mingle with the local community members.

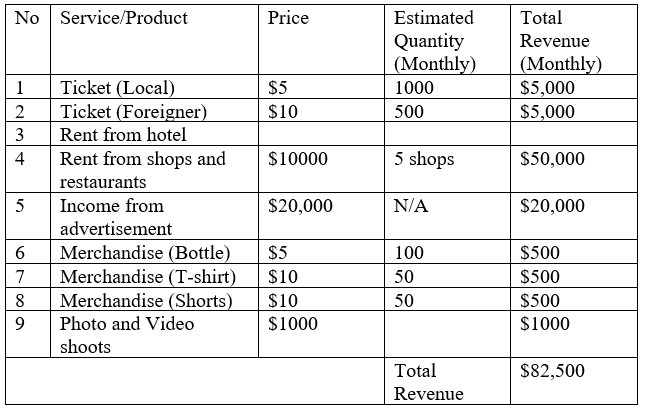

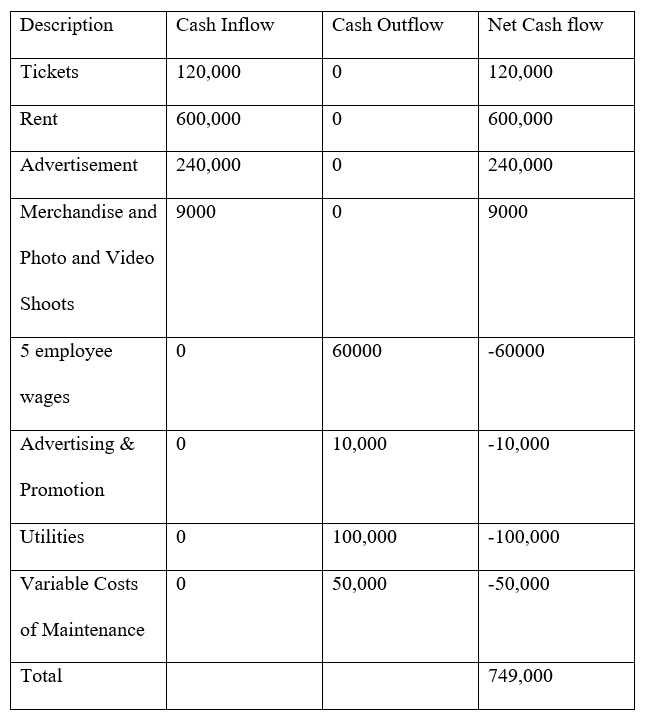

Table 1: Revenue Generation Model

From Table 1 above, it can be inferred that the site will be generating $990,000 ($82,500* 12). Therefore, after the upgrade, the site will generate $ 9,990,000 in ten years.

Relevant Cost Analysis

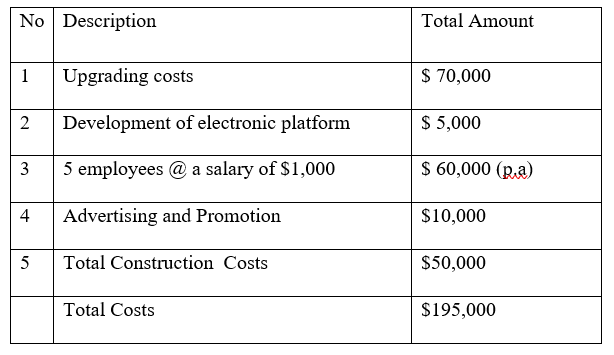

Fixed Costs

Several costs will have to be incurred before the proposed business model can be implemented. As it stands, Fort Jesus is in a dilapidated state and requires upgrading. Some of the washrooms at the site are barely functioning. It is estimated that all the upgrades will cost $70,000. Further, Fort Jesus has no on-site shops and restaurants. In this regard, some investments will be made in the construction of shops and restaurants. It is estimated that the total construction costs will be $50,000.

Additionally, there will be an investment in developing an electronic platform that makes it easier to link visitors with the hosts. Total development costs for the electronic platforms are estimated to be $5,000. Besides, five employees will be hired to assist in the overall management of the site. Each of the five employees will be under a fixed salary of $1,000 per month.

Admittedly, Fort Jesus faces stiff competition from other heritage and tourist sites. Subsequently, this means that there is a need to invest in the promotion and advertisement of Fort Jesus. For a start, we intend to spend $10,000 every year on the promotion of Fort Jesus. Similarly, for the Merchandise, Fort Jesus will collaborate with an event and management company. However, Fort Jesus will not be needed to contribute to the manufacturing of the merchandise. The arrangement will be Fort Jesus retains 30% of all the revenue from the sale of merchandise and remits 70% to the Events and Management Company.

Table 2: Fixed Costs

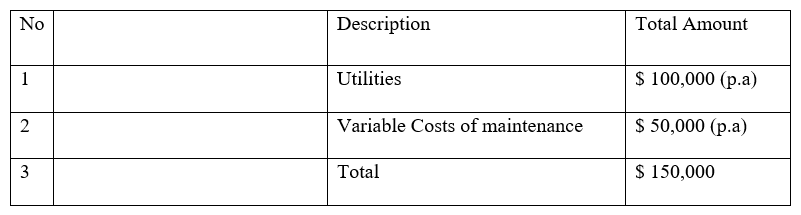

Variable Costs

Some of the costs incurred in the management of the Fort Jesus site will vary based on the extent of work involved. For example, the costs of utilities such as water, internet, and electricity will vary from one period to another. However, we have assigned these costs fixed amounts that are the approximate averages.

Table 3.0 Variable Costs

Hence, it can be inferred that every year, $345,000 ($150,000 + $ 195,000) will be the total cost required to keep Fort Jesus running successfully. In ten years, this amounts to $3 450,000.

Financial Decision

Profits

Profit is normally given as total revenue less total costs (Nilsson & Stockenstrand, 2015). In computing the Fort Jesus site’s aggregate profits, we have restricted our predictions to 10 years. Arguably, this is informed by the fact that after ten years, the market trends and dynamics might have changed completely, rendering our predictions inaccurate (Palepu et al., 2020).

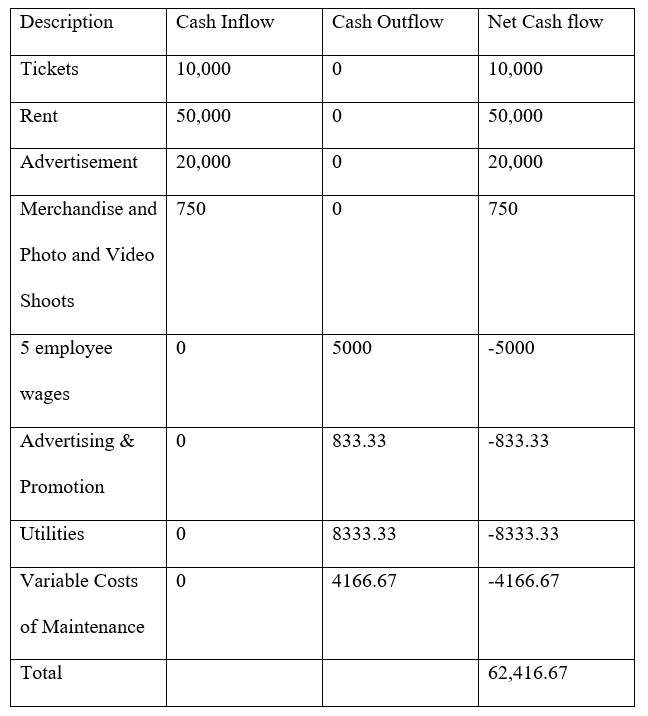

In determining the total profits, it should get noted that only 30% of the revenue from the sale of merchandise will be remitted to Fort Jesus’s accounts. Every year the revenue from the merchandise is @2500. In this regard, only $750 will be remitted into Fort Jesus’s accounts every month from merchandise sale. Therefore, this means that every month $1750 will be remitted to the Events and Management Company.

= Profit: Total Revenue – remittance to the Events and Management Company – Total costs

= $ 9, 990,000- $210,000- $3,450,000

= $6,330,000

Cash flows

Cash flow refers to the net amounts of cash, and its equivalents transferred either into or out of business (Gupta, 2011).

Table 4.0 Monthly Cash flows

Table 5.0 Annual Cash flows

Net Present Value to evaluate the project

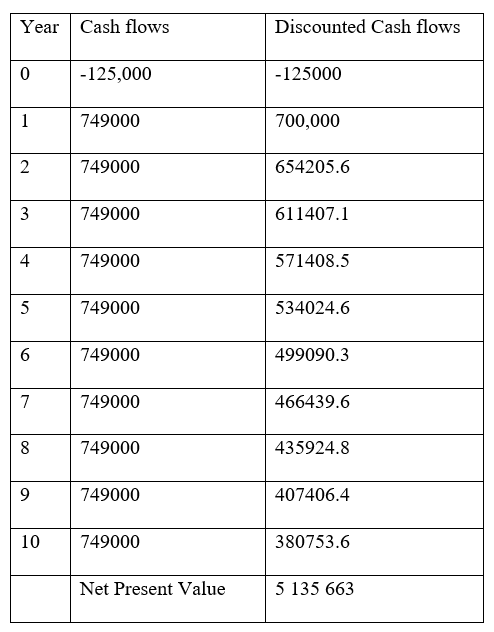

As Fort Jesus is found in Kenya, we have opted to use a discount rate of 7.0%, as it is the interest rate offered by the Central Bank of Kenya on reserves.

Table 6.0 Discounted Cash flows and NPV

From table 6.0, it can get inferred that the NPV of the proposed project is 5,135, 663, which is greater than 0 (Brigham & Houston, 2012;Brigham & Daves, 2012). Subsequently, this means that the proposed project is viable. The strength of the NPV as a tool for evaluating the viability of projects is that it considers the time value of money.

Discounted Payback Method

Although the NPV is an excellent method for evaluating the feasibility of projects, it has its shortcomings. Notably, it only focuses on cash flows and ignores other factors such as opportunity costs, which might significantly affect the proposed project (Brigham & Ehrhardt, 2013; Moyer et al., 2012).

From table 6.0, it can get inferred that the proposed project will have paid out the initial investment outlay within the first year.

-125000+700,000= 575,000

Specifically, the project will take approximately 2.14 months to recoup the initial investment outlay. As the proposed project has a positive NPV and has a discounted payback period of less than a year, it is viable.

Conclusion and Recommendations

To sum it up, the paper has presented a robust assessment of the viability of a proposed project of improving Fort Jesus. From the NPV and Discounted payback period calculations, it is apparent that the project is viable. Nevertheless, the site managers need to sensitize the local community members and gather their insights on how the project can be improved. Since the proposed project is contingent on the local communities’ goodwill, they should be involved at all stages of the project. Further, the site managers need to continually obtain feedback to see how the site can be improved further to meet their needs better.

References

Brigham, E.F. and Houston, J.F., 2012. Fundamentals of financial management. Cengage Learning.

Brigham, E.F. and Daves, P.R., 2012. Intermediate financial management. Nelson Education.

Brigham, E.F. and Ehrhardt, M.C., 2013. Financial management: Theory & practice. Cengage Learning.

Cohen, E., 2012. Major trends in contemporary tourism. The Routledge Handbook of Tourism Research. Abington, Oxon. Routledge, pp.310-321.

Gupta, A., 2011. Financial Accounting for Management: An Analytical Perspective. Pearson Education India.

Kihima, B.O. and Ariya, G., 2020. MS 20-15 Accepted for publication in Tourism Review International. Tourism Review International, 24(2-3), pp.2-3.

Kwanya, T., 2019. 10 Leveraging tourism in Kenya through indigenous knowledge. Positive Tourism in Africa.

Mahoney, D., 2012. Changing strategies in marketing Kenya’s tourist art: from ethnic brands to fair trade labels. African Studies Review, 55(1), pp.161-190.

Moyer, R.C., McGuigan, J.R., Rao, R.P. and Kretlow, W.J., 2012. Contemporary financial management. Nelson Education.

Nilsson, F. and Stockenstrand, A.K., 2015. Financial accounting and management control. The tensions and conflicts between uniformity and uniqueness. Springer, Cham.

Page, S.J. and Connell, J., 2020. Tourism: A modern synthesis. Routledge.

Palepu, K.G., Healy, P.M., Wright, S., Bradbury, M. and Coulton, J., 2020. Business analysis and valuation: Using financial statements. Cengage AU.

Pikirayi, I. and Schmidt, P.R., 2016. Introduction: community archaeology and heritage in Africa—decolonizing practice. In Community Archaeology and Heritage in Africa (pp. 15-34). Routledge.

Rogerson, C.M., 2012. The tourism-development nexus in sub-Saharan Africa-progress and prospects. Africa Insight, 42(2), pp.28-45.

Sarmento, J., 2010. Fort Jesus: guiding the past and contesting the present in Kenya. Tourism Geographies, 12(2), pp.246-263.

Sharpley, R., 2011. The study of tourism: Past trends and future directions. Routledge.

Timothy, D.J., 2011. Cultural heritage and tourism: An introduction (Vol. 4). Channel View Publications.

Timothy, D.J. and Boyd, S.W., 2015. Tourism and trails: Cultural, ecological and management issues (Vol. 64). Channel View Publications.

Timothy, D.J., 2014. Contemporary cultural heritage and tourism: Development issues and emerging trends. Public Archaeology, 13(1-3), pp.30-47.

Waugh, E., 2012. A Tourist in Africa (21). Penguin UK.