Research Study on Life Cycle Costing

Number of words: 2630

1. EXECUTIVE SUMMARY

The research reports a keen assessment and comparison of two brand new vehicles after a 5-year Life Cycle Costing. Notably, life cycle costing ensures that the decision-making process for selecting the optimum cost-effective vehicle suitable for family use within the determined period is easy. The family achieves this through the analysis, making several assumptions, with elaboration and breakdown of all expenses and rate essential in the costing and an illustrative Life Cycle costing cash flow for each model.

Considering Honda VTi-LX Hybrid and VTi-LX Petrol, Honda VTi-LX Hybrid is slightly expensive, but both are suitable for family use and got similar operational costs. Comparatively, petrol’s resale value depreciates slower than the hybrid, hence having a higher resale value. Therefore, according to LCC analysis, after keen considerations on costs and revenue, Honda VTi-LX Petrol is cheaper than Honda VTi-LX Hybrid.

2. INTRODUCTION

The life cycle costing technique is critical for economic evaluation, which accounts for all relevant capital and operational costs. Life Cycle costing goes ahead to bring all aftertime costs to a tailored current single value.

This report has a complete Life Cycle Costing for 5-years comparing two vehicles Honda VTi-LX Hybrid and VTi-LX Petrol. Both are automated gears with similar specifications; the major difference is that one is Petrol-powered while the other uses hybrid technology.

This report entails several assumptions based on the critique, an elaboration on funds flow giving all expected costs to current value, a well-detailed structure on all accompanying costs and an exact Life Cycle Costing for the two vehicles. Principally, after considering all costs and factors, the analysis determines which car has the lowest NPV.

3. PRESUMPTIONS

This assumption has been made to determine variables reviewed in this Life Cycle Costing analysis.

- Based on Life Cycle Costing, this report will be carried out using the Net present value criteria for 5-years.

- The purchase is to be facilitated by a 5-year car loan covering all drive away costs.

- The family enjoys travelling to various destinations for holidays; this new vehicle will be a spacious back model to give more room for luggage and accommodate everyone comfortably.

- The report will compare these two vehicles in terms of their specific features and retail market price.

- The model is a family vehicle meant for private use; therefore, this report will not consider tax implied if meant for Public Service.

- The family intends to resell the vehicle after 5-years, and the report will give an estimated resell value with the help of Life Cycle Costing analysis.

- LCC will not consider licenses fees, measures and requirements that the car will have incurred over 5-years.

- The family will cover insurance on an annual basis for a period of 5-years.

- Before licensing, the vehicle will have to be inspected.

- According to Australian vehicle licensing, there will be a secondary third party indemnification, also known as car injury financial protection.

- Previously, the family records no accident cases; thus, this analysis assumes there will be no involvement in accidents throughout the period in which they have the car.

- This report will not take into consideration technical repairs like tyre replacement. Otherwise, the calculations will consider,

- Operational costs annually.

- The loan will be at a constant rate of 6% per annum in terms of capital cost.

- Fuel prices are also assumed to be the same for the consecutive five years,

- It is presumed that no calamities or unexpected occurrence will have an effect on the Life CC model

4. DISCOUNTED CASHFLOW TECHNIQUE

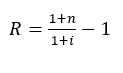

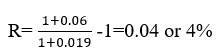

The life cycle pricing for these two vehicle models analyses will use the (NPV) technique to integrate all the revenues and expenditures over the five years to a current time base. Ideally, the process involves several steps. First, the selection of a markdown rate depending on the opportunity cost. Ideally, the discount rate selection in this step will apply the car loan interest comparing rate (6%) that is the price of the car as the Nominal IR (n). Essentially, the nominal IR comprises two differing components. The first component is inflation (i), while the second is the rate of return (RR). In this case, the life cycle costing is inconsiderate of the inflation rate within the money flow assessments (Hasan et al., 2021). Therefore the discount rate excludes the inflation rate too. Hence the markdown is calculated using the real return rate written as;

The inflation rate plays a major role in the calculation. Considering the mean inflation rate within the five-year term is 1.9 % and is constant, the real return rate is;

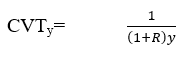

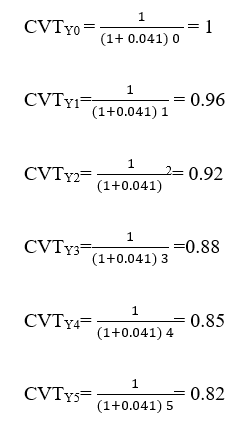

Resultantly, having the R and DR enables one to find the current value factor;

Where y is the real year when there is the calculation and R the proportion of return the CVT in all five years LCC is;

5.VALUES

5.1 DRIVE AWAY FEES

5.1.1 Corporation’s Suggested Retail Price

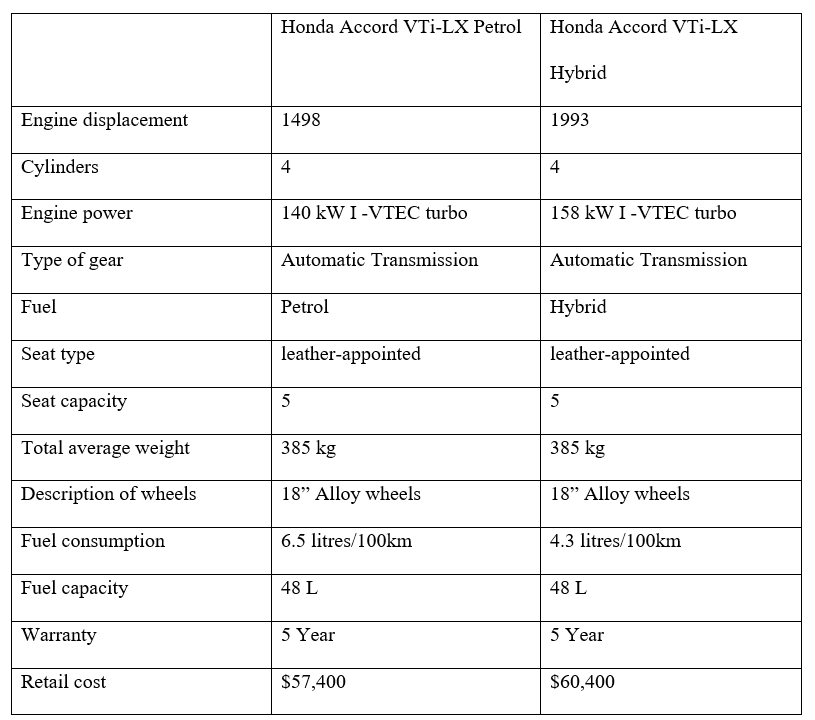

The sedan family cars picked for this LCC are;

- Honda Accord VTi-LX Petrol

- Honda accord VTi-LX Hybrid

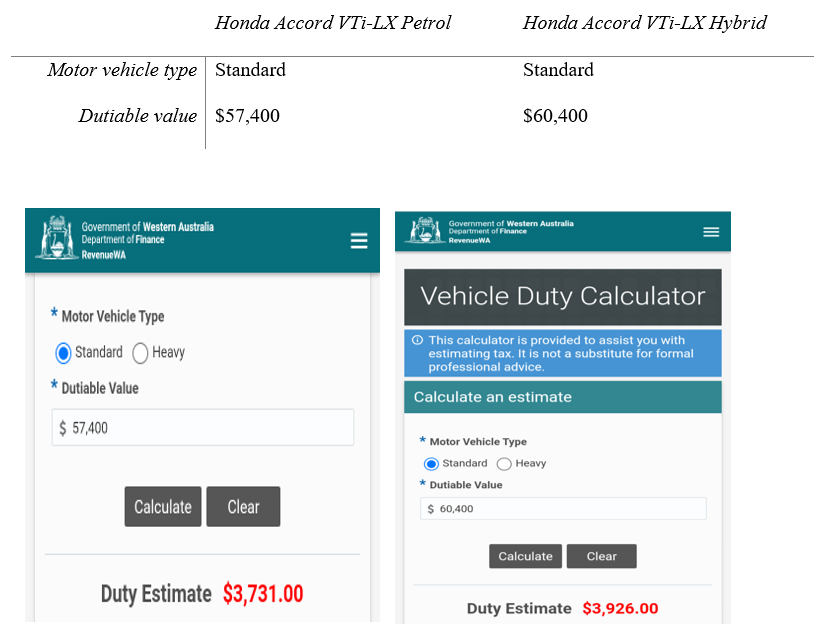

5.1.2 Stamp Duty

The duties Act of 2008 states that a car obtaining a stamp duty is mandatory. Ideally, this is tax chargeable at different rates when acquiring a new property. The new vehicle license transfer is made after the payment of the stamp duty. Moreover, the total cost depends entirely on the different variables, such as the entire vehicle mass that the manufacturer sets. The GVM essentially notes the total weight that the car can carry. Vehicle usage and the value are also factors to consider when determining the stamp duty.

5.1.3 Delivery charges

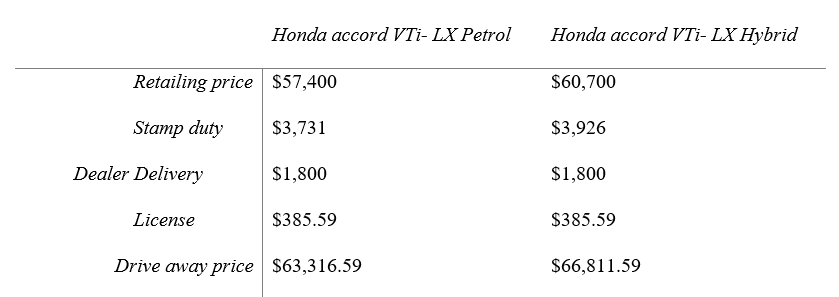

The dealer delivery price is a fee on the transport cost from the sales company to the owner of the car. The dealer sets the charges to cover the expenses incurring on the delivery of the new vehicle. Ideally, it comprises the cost of the vehicle leaving the assembly station, cleaning and all other car preparations before it reaches the owner. The delivery charge from the vehicle assembly to the family for each of the vehicles is $1800.

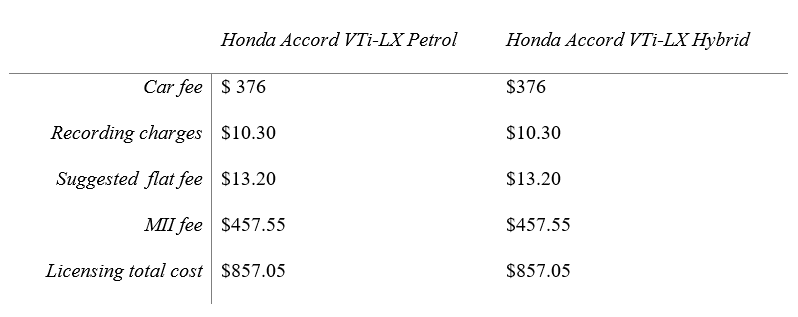

5.1.4 Licensing

Australian government demands that all cars get registered within their territory. Ideally, the regulations differ from state to state, complicating the car purchasing process. The rego is a mandatory requirement for all vehicle owners, and it must be under the address and name of the vehicle owner (Graham-Rowe et al., 2012). Therefore, there are several costs in association with vehicle licensing. The price is a result of compiling several procedures to ensure the vehicle’s roadworthiness. Application for the license is submitted at a vehicle service bay in person (JR, n.d.). The license fee is $ 24.56 per 100kg of the vehicle tare mass as of 2021. Therefore the lighter the car, the cheaper it is to license. The tare mass for both vehicles is 1570 Kg; hence the licensing fee is $ 385.59.

5.2 OPERATIONAL COSTS

5.2.1 Purchasing finance

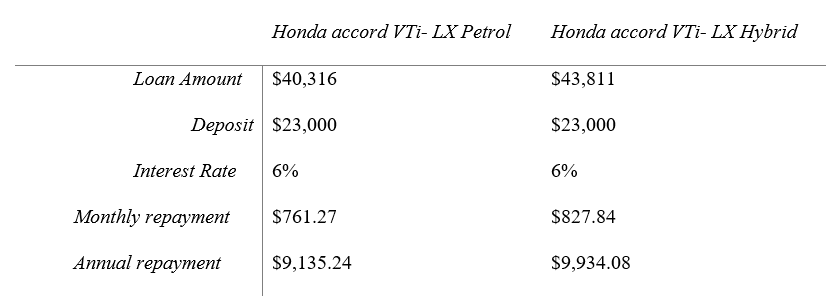

The family needs a ready source of funds to cater to all the expenses incurred during the purchase. Principally, the family obtains a car loan to finance the drive-away costs.

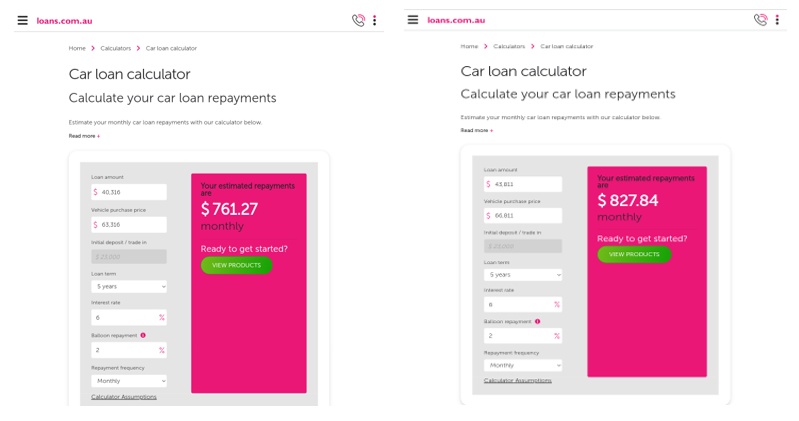

Resultantly, to show the different quotations, the preparation of two documents showing the variations is crucial. The two citations determine the cost of the separate loans. Essentially, each scene considers the loan term of five years and a 6% per annum interest rate comparison.

5.2.2 Renewing the license

Payment of the license is annual, as stated on the terms and conditions of the registration. The license renewal is recommended when a car has an appointment in a state but wishes to change the location. However, the motor injury insurance in the license fee only covers the family car if it operates within the country. The MII protects anyone in an accident where they sustain serious injuries. The breakdown below includes MII and 10% GTS on the insurance. The charges make up a huge portion of the license fee, and these charges base on the tare mass of the vehicle.

5.2.3 Insurance cover

The most suitable insurance cover for the family is the comprehensive cover. The car insurance falls under the property insurance. Therefore, the cover ensures the cover for accidental loss on the car and damage falling on other people’s properties if an accident occurs. Moreover, the cover insurers the family during floods, fires, or storms that may damage the vehicle (Graham-Rowe et al., 2012). Notably, the two quotations are done under similar assumptions and using the same driver’s identity.

5.2.4 Fuel

Fuel estimation for the entire year is through the consumption of the vehicle engines. The average distance a person onboard covers in one year in Perth is roughly eleven thousand kilometres. Moreover, the models differ in the systems as one is a hybrid while the other is a petrol vehicle. Therefore they have different consumptions.

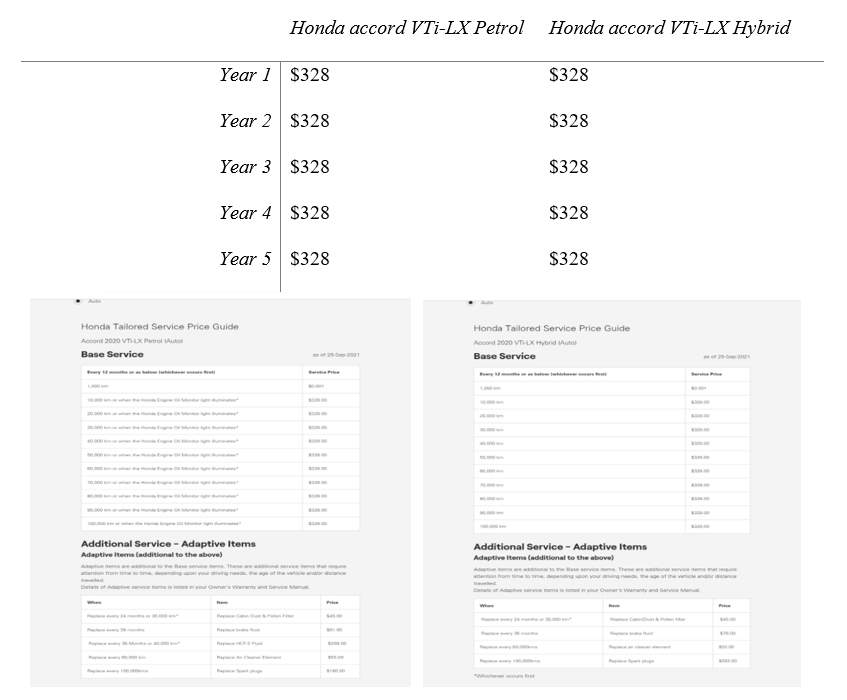

5.2.5 Servicing

The two vehicles have differing recommendations for the time during which the cars are taken for service. Vehicle servicing includes oil change, fittings and repairs, as the vehicle is prone to wear and tear during its usage. The five low charges apply to the new Honda cars only. The Honda Accord VTi-LX petrol recommends service after twelve months or when the monitor light for the engine oil illuminates. The family takes the vehicle for service after every ten thousand kilometres covered and pays $328 for the service. Both cars get servicing one time annually.

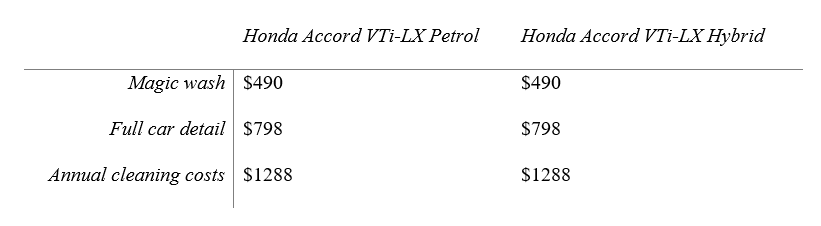

5.2.6 Cleaning

The family considers car hygiene as very critical. Notably, the car is for daily use and therefore, the annual cleaning fee is a standard estimation. The magic wash removes the grime from paint, plastic trims, exhaust tip and chrome. Since the family loves a dustless dashboard, it is the perfect service to be done ten times a year. The full car detail brings the vehicle to the best condition. Once the car is clean, the cleaning company work their way around it, rejuvenating all areas. The family will only do this service twice annually.

5.2.7 Wheels

The life expectancy for the car wheels is after covering 24,854.8 miles. The car would travel an average of 6835 miles annually. The wheel replacement for the model is after three years of car use. Despite the type of model under consideration, both the rear and front wheels would undergo rotation to ensure balance in wear and tear. The wheels exchange is therefore done at the same time. Hence the price of replacing and delivery for both hybrid and petrol Honda accord 18” is $ 636

5.2.8 Maintenance

Vehicle maintenance involves several procedures. Ideally, the guidelines are meant to cut down the costs associated with neglecting a vehicle. The processes include checking all vehicle fluids, belts and hoses, battery quality, brake system, tune-up schedules and general system inspection. The annual maintenance cost for the two vehicles is $799.

5.3 RESALE

Regarding the estimations of the reselling rates, the two five-year-old cars are in consideration. The Honda Accord models are bell-weather cars, and they retain their values for a long period. The new models have their prices rising largely over the years. The significant rise in prices also means that they depreciate fast. For the Honda accord petrol, the resale value after five years of ownership is $38052 while hybrid goes for $40040

6. LIFE CYCLE COSTING

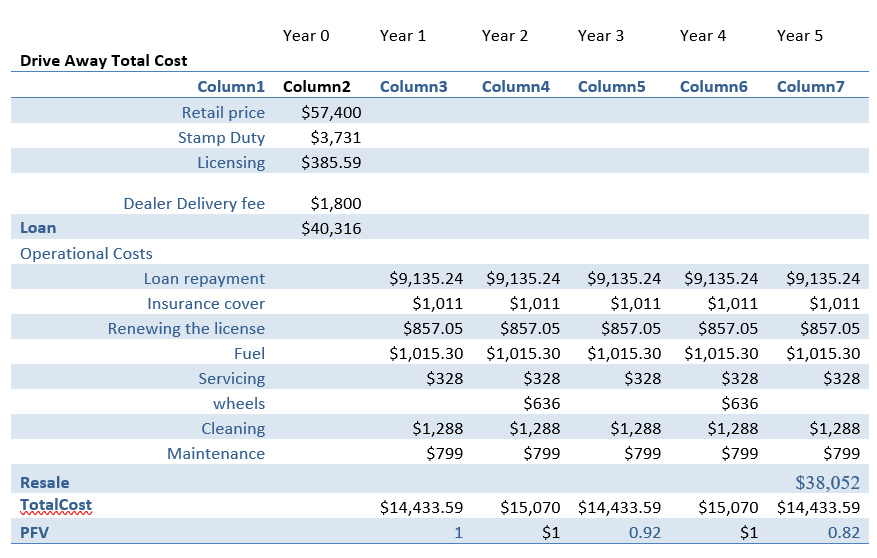

6.1 Honda accord VTi-LX Petrol

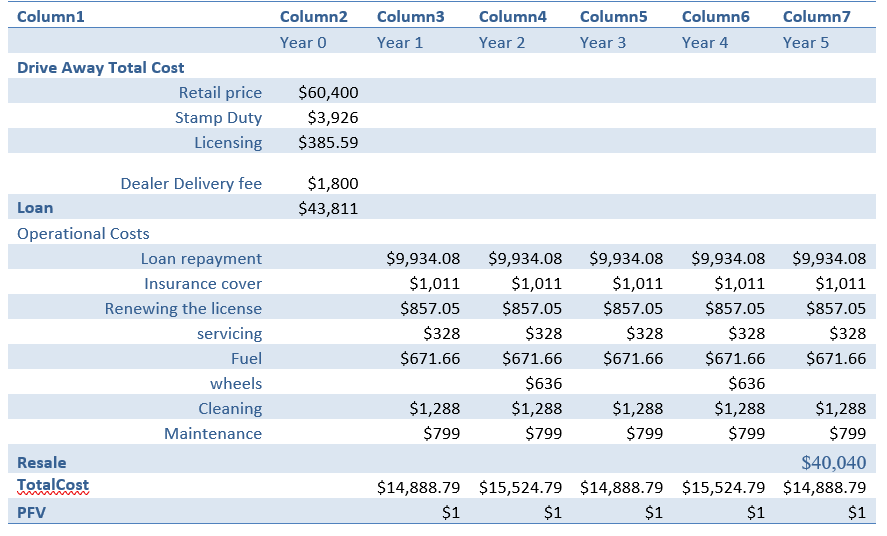

6.3 Honda accord VTi-LX Hybrid

7. CONCLUSION

Generally, contemplation of purchase of a new vehicle applies the process of life cycle costing. The brand new cars are Honda accords one is hybrid while the other is a petrol car. They are from the same manufacturer and model. Since the vehicle is for personal use, the life cycle considers the resale value but ignores the tax implications. The LCC is a systematic analysis, and its attributes include being a decision making and appraisal method. The technique aims to find the costs of the two vehicles, including the future costs to own the assets. Ideally, when comparing the two models, it is true to conclude that the Hybrid model is more expensive than petrol.

Calculating LCC needs the expenditures and total capital, including the operational costs. Essentially, to have a roadworthy vehicle, the retail price, stamp duty and rego fees are considered. Moreover, the dealer delivery fee is also a high cost to account. The capital cost in the analysis is $63,316.59 for the petrol and $66,811.59 for the hybrid. Therefore the family would need a ready $66,811.59 for the hybrid comparing to the $63,316.59 for the petrol model. Hence the drive-away costs for the two models from the same manufacturer.

The second important expense associated with using the vehicle for the next five years includes the maintenance procedures. In addition, the cars need annual servicing, thorough routine cleaning, licensing and insurance. Finally, the operating costs account for the price in association with the need to use the vehicle. Most of the car’s specifications are similar, and so are the operational costs. The major differences are the loan amounts, interest, and monthly deposits.

While the cost of the Honda hybrid is higher than the petrol make, it is worth the extra money. The car ranks high due to the user-friendly interface, swift acceleration and spacious cabin compared to the petrol Honda Accord. The hybrid also gives more punch for the frequent driver. However, the plenty of energy tapers off when on highway speeds.

Bibliography

“Accord.” n.d. Www.honda.com.au. https://www.honda.com.au/cars/sedan/accord.

“Eagers Automotive Limited | Automotive Group | Australia.” n.d. Eagers Automotive Limited. https://www.eagersautomotive.com.au/.

Graham-Rowe, Ella, Benjamin Gardner, Charles Abraham, Stephen Skippon, Helga Dittmar, Rebecca Hutchins, and Jenny Stannard. 2012. “Mainstream Consumers Driving Plug-in Battery-Electric and Plug-in Hybrid Electric Cars: A Qualitative Analysis of Responses and Evaluations.” Transportation Research Part A: Policy and Practice 46 (1): 140–53. https://doi.org/10.1016/j.tra.2011.09.008.

Hasan, Md Arif, David J. Frame, Ralph Chapman, and Kelli M. Archie. 2021. “Costs and Emissions: Comparing Electric and Petrol-Powered Cars in New Zealand.” Transportation Research Part D: Transport and Environment 90 (January): 102671. https://doi.org/10.1016/j.trd.2020.102671.

J.R.n.d. “Transport Related Fees.” Www.transport.wa.gov.au. https://www.transport.wa.gov.au/aboutus/transport-related-fees.asp.

Stimson, Robert, Martin Bell, Jonathan Corcoran, and David Pullar. 2012. “Using a Large Scale Urban Model to Test Planning Scenarios in the Brisbane-South East Queensland Region*.” Regional Science Policy & Practice 4 (4): 373–92. https://doi.org/10.1111/j.1757-7802.2012.01082.x.