Situation Analysis of the Caffè Nero Group Ltd

Executive Summary

This report represents the situation analysis of the Caffè Nero Group Ltd. in the UK and its strategies for the international expansion process. This report is intended to facilitate an understanding of the company’s potential for internationalisation. The report includes a brief overview and history of the company with a timeline which illustrates its expansion in the UK.

There follows an internal analysis of the company (SWOT) and external analysis of United Kingdom and Switzerland (PEST), followed by a description of the trends in Switzerland. The cultural analysis of the UK and Switzerland is undertaken by using Hofstede’s model, which is based on Individualism, Power Distance, Masculinity and Uncertainty Avoidance indices. Porter’s Diamond is the framework which is used to evaluate the nation’s competitive advantage. It is based on the analysis of the factor conditions, demand conditions, related and supporting activities, company’s strategy, structure and rivalry and government oriented issues, related to company.

The report ends with the proposition of the future strategies and the strategically orientated recommendations for the company, which are based on the findings from the analysis.

Methodology

This report is based on secondary research, using only secondary data, which includes information from the World Wide Web, academic literature, newspapers, academic journals and online databases.

Limitations

Secondary data is in general rather limited in terms of:

- Reliability of the resources – some sources provide misinformation on the specific topic, therefore there is the problem of finding reliable information.

- Data classification – some reports are poorly classified and it is time consuming to find the specific information required.

- Non-availability of data – some of the data is not available anywhere. This is where primary research is essential.

- Data language – the comparison of two different markets, one of which is with a non-English speaking population, puts the restraints on the correct understanding of the data provided.

Company History and Overview

The Caffè Nero Group ranks as one of the three largest operators of espresso shops in the United Kingdom operating 263 coffee shops in more than 50 cities and towns in the United Kingdom (Datamonitor, 2007), with sites from Brighton to Glasgow. The company employs more than 1,969 people (Datamonitor, 2007), thus being classified as large scale enterprise.

The first Caffè Nero coffee shop was opened in 1990 in the South Kensington area of London. With the opening of the first coffee shop they introduced to the British the totally foreign concept of standing while drinking coffee. In addition to this the British, Londoners specifically, weren’t used to such types of hot drinks as mocha, latte or espresso, because of the tradition of drinking tea (Datamonitor, 2007).

Over the next six years following the opening of the first coffee shop, Caffè Nero Group PLC opened another four coffee shops in different locations in London, which indicates the growth of demand as the result of acceptance of the product by Londoners.

Products offered

According to the official website of the company, the Caffè Nero units offer different types of coffee (espresso, cappuccino), and a great variety of food (sandwiches, soups, Italian wraps, paninis, pasta and pastries), which makes the Caffè Nero cafés not only coffee shops, but a place where you can also have a nice meal. Nonetheless the fundamental product still remains their specific coffee.

Target market

Caffè Nero at the beginning of its rise in the coffee retail business targeted mostly middle income Italian Londoners or tourists. Nowadays the main target market is middle income middle-aged customer groups (Londoners/tourists or students) or businesspeople who aim to have coffee on the go because of high occupancy and longer working hours.

Consumer behaviour and lifestyle

UK consumers, as most consumers from other European countries, are also becoming more adventurous in their food choices and are seeking a wider array of food and beverage offers, including Fairtrade, organics and healthy food options and are also eating and drinking more on the move (www.uktalkmarketing.com).

Hall (2000) points out that the growth of café society could be modernized by the growth of the rate of the female population in society based on the argument that in general women prefer to spend their leisure time in a non-smoky and clean environment.

According to the IGD official website (14/08/2006) there are some more lifestyle changes that appear to be the main demand drivers:

- The image of the hot beverage represented as the main part of a lifestyle

- 24-hour product offered instead of meal products offered at specific times

- The need for an energy-provider for on-the-move lifestyle

- As a result the rate of coffee drunk every day around the world is two billion cups per day, which reflects coffee as the second most widely operated product, after oil, valued at a total of US$140 billion

The Caffè Nero Group is managed by Gerry Ford, who in 1997 through Paladin Associates Ltd. with a group of investors purchased the five Caffè Nero coffee shops. The new management team with financial sponsorship from Banc Boston redesigned all of the Caffè Nero units and turned them into a small established chain.

Caffè Nero Group PLC Timeline after the year 1999:

End of 1999: Caffè Nero Group PLC’s partnership with the British Airport Authority (BAA) and as a result expansion to 13 bars and new openings outside of London and on BAA territory.

End of 2000: Expansion to 30 sites throughout the United Kingdom.

2002: Acquisition of 26 Aroma coffee sites from McDonald’s. It makes first pre-tax profit in six months.

2004: Partnership with House of Fraser and as a result expansion to 145 sites (some of them are located in House of Fraser’s shops in London’s Regent’s Street, London’s Victoria, Croydon, Glasgow and Guildford).

June 2004: Caffè Nero Group’s purchase of eight Coffee Republic units in Cardiff and Southern England for its 5.7% stake in the company. The company’s turnover grew by 25%. (www.caffenero.com, 2004)

SWOT Analysis Of Caffè Nero Group PLC

SWOT is the internal analysis of the company which assists in revealing the company’s strengths, weaknesses, opportunities and threats in the competitive landscape of the market.

Strengths:

Cheaper prices in comparison to the rivals’ products prices (Costa Coffee, Starbucks)

A small cappuccino in Starbucks is £2, in Costa Coffee £1.79, in Caffè Nero £1.55 (Telegraph, 5 November 2007).

A wide range of food proposed in addition to coffee products (food sales account for 35% of total sales), according to the company’s official website.

Strong brand positioning in the domestic market as a European-style chain of coffee shops is the central part of the company’s business model.

Rather strong and intensive promotion campaigns (e.g. loyalty cards for customers).

Clear Unique Selling Point that differentiates Caffè Nero from its rivals – Starbucks and Costa Coffee – the Continental-style offering which is different from the American style of its competitors.

Reduction of costs by renting the premises, rather than acquiring them for Caffè Nero’s units.

Weaknesses

Location of the Caffè Nero’s units – lack of units in Central London, more in the UK provinces, as the consequence of saturation of cafés and bars on High Streets.

Caffè Nero does not have the experience of going international, therefore it could be problematic for it to penetrate new foreign markets.

Opportunities

Expansion into the European mainland, starting with expansion to Western Europe.

The partnership with the Royal Bank of Scotland – acquisition of £4 million credit is available for the new openings and expansion.

Threats

High possibility of terrorist attacks in the domestic market – United Kingdom.

The decline in the number of tourists coming to the UK (domestic market) after the terrorist attacks in July 2005.

The image is relatively easy to copy for new entrants into the market, and which would intensify the competitive landscape in the market.

Possible rise of rental prices in the future as the continuation of the present rise in rental prices of over 30% for the past year.

The SWOT analysis reflects the current situation of the Caffè Nero Group, which has a lot of beneficial points, such as cost reduction strategies, strong brand positioning, intensive marketing campaigns and a clear differentiation point, which shows the company’s high potential for internationalisation into Europe. However, there are some weaknesses, one of them being lack of experience in going international, thus some problems could arise while penetrating foreign markets. In addition to this there are some threats but they are external and cannot be influenced. But the conclusion of the analysis is that the company is ready to go international at this point of their timeline for the reason of high level of profitability and large market share in the domestic market.

Another reason is the domestic market – the UK is a mature market for branded coffee shops, since there are a lot of chained retail units – Costa Coffee and Starbucks are just two of the examples of branded coffee chains in the UK. Although the market share shows that the UK market (specifically London) has the potential for market saturation of branded coffee units, the coffee retail industry appeared have explosive growth – 37% for the past five years as shown in the Caffè Nero Group PLC financial report for May 2003.

PEST Analysis Of UK (Domestic Market)

PEST is the external environmental analysis of markets which reflects the economical, political, social and technological indicators of the country.

The United Kingdom of Great Britain and Northern Ireland is a country of 244,820 sq. km of territory located on the north-west of mainland Europe and populated by 60,587,300 people (www.wikipedia.org, 2007).

Political factors:

The United Kingdom became part of the European Union in 1973, but is not part of the European Monetary Union. There is a threat of terrorist attacks, as a result of the UK’s economic and political importance in the world and its involvement in US military engagement in Iraq.

Economic factors:

The UK is the fifth largest economy in the world in terms of GDP – US$1.6 trillion. Average annual growth is 0.7 % as a result of expansion of the service sector of 0.8%, according to Datamonitor (2007).

The currency used in the UK still remains the pound sterling, which is rather strong in comparison to the Euro and the dollar. According to BBC News (April 2007)the pound sterling reached its highest level against the dollar since 1981 (£2.099493 pounds to the dollar).

For the period 2002–2006 the UK’s economy grew by 2.6% and as a result the economy is not dependent on fluctuations in domestic demand.

Potential was created through the reduction of the personal income tax rate from 22% to 20% as well as the reduction of corporate tax from 30% to 28% after April 2008, according to Datamonitor (2007).

A rise in the inflation rate by 0.2% in 2007 compared with 2% inflation rate in 2006, as a result of the rise in transportation costs as well as in food and beverage costs (Appendix 6).

Social factors:

The UK domestic market includes a high percentage of immigrants. The percentage of the workforce based in the UK that is foreign is 7-8%, a 2.32 million population (Guardian, 30 October 2007).

There is a high volume of different cultural and ethnic groups, since the UK’s membership of the European Union and particularly since the 12 new members entered the EU in May 2004; 9.9% of the overall UK population is non-white (UK National Statistics, March 2007).

Technological factors:

The UK is rather advanced in terms of technology, but a lack of skilled labour in the field of technology (i.e. engineers), high public debt and low public investment do not allow sourcing R&D in innovative technology.

PEST analysis of the foreign market – Switzerland:

Switzerland is located in the Western part of the European Economic Area territory, but is not part of the European Union or the United Nations Organization. It has a population of 7.5 million people and an area of 41.285 square km. (www.wikipedia.com, 2005)

Political factors:

Switzerland is an independent and politically neutral country with a stable economy.

It has 26 cantons, each with its own constitution, parliament, government and courts which are totally separate from one another.

It is not part of the European Union/European Monetary Union or United Nations Organization but has been part of the Euro-Atlantic Partnership Council (EAPC) since 29 May 1997.

Economic factors:

The GDP of Switzerland was US$377.2 billion in 2006 and was predicted by the IMF/IEU to rise to US$389.4 billion.

GDP (purchasing power parity) was US$272.3 billion in 2006 and US$283.2 billion in 2007 – one of the highest per capita incomes in the world.

Tax varies between the cantons (Euromonitor, 2007).

National debt is US$199.4 billion, which is 51.2% of GDP. This is over the critical margin, but is balanced with non-existence of external debt of the country (Suisse national statistical data, 1999).

The Swiss franc remained relatively stable and strong against the Euro since mid-2003 at a value of about CHF1.55 per Euro (www.gocurrency.com, 2005).

The forecast for growth of inflation was from 0.6% to 2% from 2007 until 2012, according to the Economist Intelligence Unit and thus a rise in the housing rental prices.

Social factors:

There are four different official ethnic groups and four different official languages (Euromonitor, 2007).

A new trend in Switzerland, as throughout Europe, is health-consciousness,according to Euromonitor (2007).

The different cultural beliefs and traditions between the cantons leads to problems of segmenting the market, according to Euromonitor (2007).

Technological:

Switzerland has a modern and widespread communication system (Euromonitor, 2007) and the most extensive and efficient public transport infrastructure in the world (Euromonitor, 2007).

Comparing the PEST analysis of these two countries it is clearly reflected that the UK is a rather difficult market in terms of operating the businesses in, for the reason of the number of weaknesses and pitfalls in the economic and technological field, whereas in Switzerland there is a rather beneficial field for penetrating the market in terms of economy and technology. The cultural aspect of the analysis is relatively similar between the two countries in terms of a large number of immigrants, different ethnic groups and different religions. Switzerland is not part of any union thus the approach for entry into their market for foreign companies is relatively hardened in terms of tax and legal issues.

Trends in Switzerland

According to Euromonitor (2007), there are several trends in the Swiss chained cafés/bars market which could be essential for Caffè Nero’s market penetration.

- Swiss customers tend to spend more time in the cafés or restaurants in order to eat or drink than spend the time at home, preparing food, therefore the demand for cafés and restaurants in Switzerland is much higher than elsewhere.

- In Switzerland chained, branded fast food units are much better positioned in terms of Swiss demand than non-branded fast food retail units.

- Swiss customers appreciate the stylish, comfortable and modern style of the branded fast food retail units, where they can not only drink coffee or eat something but also relax and enjoy the atmosphere.

- Because health concerns are a new trend throughout Europe, especially in Switzerland, the branded fast food retail units positioning themselves as health conscious, clean and smoke free units gains real demand among the Swiss customers.

- The European customer groups tend to have busy lifestyles – longer hours at work, and as a result higher income and less time for recreational and leisure activities.

Considering all the trends happening in the sector of chained cafés and bars and Swiss consumers it can be seen that Switzerland is a relatively attractive market for Caffè Nero products and services as for the chained café units.

Target Market In Switzerland

According to the demographics shown in Appendix 8, which show that the largest age group in Switzerland is 30–54 years old, as well as the most employed (Appendices 10 and 11). Therefore the main target group would be business people in the age group. As there are a lot of Hotel Management Schools in Switzerland it is essential to target international students as well. Moreover the general customer group would be the middle income, middle-aged, consumers that would come to the coffee shop for the purposes of socializing.

Hofstede’s Model

Geert Hofstede’s model represents cultural differences between the countries which are classified into five cultural dimensions – power distance index, masculinity index, uncertainty avoidance index, individualism index and long-term orientation index. His research was based on questionnaires which he distributed among IBM employees.

According to Geert Hofstede’s model of analysis of cultural dimensions of the UK and Switzerland there is some similarity in terms of the power distance index and masculinity. The power distance index is low in both countries – scores of around 35, which shows that in both countries there is no clear and strict hierarchical system.

The masculinity index is 66 for both countries, which indicates that there is a clear difference between male and female roles in the society. Females are beginning to partially dominate in the business world but this tendency is not clear.

There is a relatively large gap in the individualism score between the UK and Switzerland. In the UK the individualism index score is 89 and in Switzerland 68. This indicates that the population in the UK is less affected by group opinion and team work than in Switzerland.

The uncertainty avoidance index in Switzerland is higher (58) than in the UK (35). Therefore people in Switzerland try to secure themselves more in terms of a larger amount of savings and insurance than in the UK. But as shown in the annual savings tables (appendices 3 and 4) there is no significant difference in terms of annual savings and the numbers are almost the same.

Based on Hofstede’s model there is no great cultural difference between these two markets, apart from some disparities in terms of the individualism index and uncertainty avoidance. Nonetheless the individualism score in both countries is above average which represents the general individualistic approach to life and to business; therefore market penetration is less affected in terms of cultural restraint for market penetration.

Limitations of the model

There are some limitations to this model. First of all it was based on questionnaires distributed among IBM employees; therefore the research is based on the values of the employees in one unambiguous working environment. In addition to this Hofstede’s model does not take into consideration that the countries can be split up into regions, like the United Kingdom of Great Britain or Switzerland and that the culture is not homogenous in these countries.

Porter’s Diamond

Factor conditions:

In the UK there is a low level of skilled labour and poor customer service standards compared to other European countries. The opinion of chairman of the CBI Steve Sharratt (13 August 2007) the lack of a skilled workforce put some restraints on the expansion of small and medium enterprises and meeting the appropriate demand (http://www.personneltoday.com). According to Euromonitor (2007) labour productivity per hour was much lower than in other developed countries and it reveals a low percentage in use of capital and labour inputs and a lack of innovative products. The infrastructure in the UK is rather weak, according to information in Euromonitor (2007) and that leads to a lack of research and development in the technological sector and innovative technology.

Demand conditions:

According to IGD (14 August 2006), for the period 1997 to 2005 the chained café/bar sector grew from 778 to 2,428 outlets, a growth of up to 200%, thus defining a relatively large market size and a high demand for it, with a potential to become saturated (http://www.igd.com).

From Caffè Nero’s financial report for the year 2006, the turnover for this company grew by 28% for the period 2003–2006 and amounted to £50.5 million (2006). This illustrates the growing demand for the products and services of this company.

Related and supporting activities

According to Caffè Nero’s official website the main supply of coffee beans comes from South America which means suppliers do not have a high degree of control over the company and the company is highly dependent on its suppliers.

The Caffè Nero Group has not undertaken research into foreign markets, it has not yet had the experience of going international; therefore the recruitment of a market research agency is essential for the company. There is a wide range of market research agencies available in the UK for companies aiming for internationalisation. Euro Field Work or Green Light Research Ltd are some of the examples of well-known research agencies in UK.

Firm strategy, structure and rivalry

The main strategy used by Caffè Nero is the cost reduction strategy, which refers to the reduction in labour costs and premises costs. The Caffè Nero Group seeks to rent premises rather than acquiring them in order to operate in there. In addition, coffee chains tend to rely heavily on international labour – Caffè Nero alone employs staff from 66 nationalities, according to the company’s official website, therefore the labour costs are minimized because international labour can be much cheaper than the British labour force. The standard rate for staff under the age of 22 was £5.05 per hour in 2006, but it was not unusual for managers to earn up to £19,000 per annum (http://www.personneltoday.com, 2006). This strategy appears to be beneficial, according to Caffè Nero’s growth and pre-tax profitability.

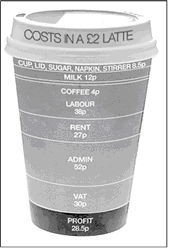

Costs Estimates

Appendix 7 represents the approximate model of the costs involved in producing one cup of latte. As seen on this model the costs are divided as follows by percentage:

Cup/Lid/Sugar/Napkin/Stirrers – 4.25% of the total cost

Milk – 6% of the total cost

Coffee – 2% of the total cost

Labour – 19% of the total cost

Rent – 13.5% of the total cost

Administration costs – 26% of the total cost

VAT – 15% of the total cost

Profit – 14.25% of the total cost

Some modifications could take place in counting the costs for one cup of latte, because if the production of coffee is based in the domestic market, then the administration costs will be lowered, because the administration costs fluctuate according to the type of market for penetration and type of market entry strategy. Moreover there is always the continuous growth in the costs for food and beverages, because of the significant inflation rise in past years.

“The farm gate price of milk has risen up to 40 percent in the past six months because of the worldwide boom in demand, fuelled by the rapid economic growth of China and India” (Telegraph article, 5 November 2007).

The hierarchical structure of the company is important in terms of the similarity in the structures of the companies between domestic (UK) and foreign market (Switzerland) according to Hofstede’s model. The company has a very strong chain of command – it is managed by three directors, – Gerry Ford (Chairman and CEO), Benedict Price (Financial Director) and Jonathan Hart (Managing Director) – which is advantageous for the company (http://www.caffenero.com, 2007).

In the UK there are three leading coffee shop/bar companies that have 58% of the UK market share, Costa Coffee, Starbucks and Caffè Nero, with a high level of competition in the domestic market, which is an advantage for a nation’s competitiveness. This high rate of rivalry will result in less effect of the global competition for the company while internationalising.

Caffè Nero and its two main rivals, Costa Coffee and Starbucks, account for 43% of the UK branded market, as shown in Caffè Nero Group‘s financial annual report.

According to retail analysts Allegra Strategies, Starbucks has a 26% market share and Costa Coffee 18% in contrast to Caffè Nero’s 12% market share.

Government

There are several limitations and restraints that are put by government that prevent the company from gaining competitive advantage on a global scale. According to Euromonitor a low level of investment in the public sector depresses the rate of fixed capital formation, which results in disadvantage for a nation’s competitiveness.

The high rate of taxation makes the UK an unattractive place to set up business in. At the time of writing according to HM Revenue and Customs in the UK the starting rate of income tax was 10%, the basic rate is 22%, although according to Datamonitor there was the forecast that this tax would be reduced to 20% after April 2008 and the higher rate is 40%. The standard rate of VAT was 17.5 % and the reduced rate 5%, according to HM Revenue and Customs in UK, whereas in Switzerland the VAT was 7.6% at standard rate and 3.6% or 2.4% at reduced rate (Euromonitor, 2007). Corporation tax was 30% in the UK (HM Revenue and Customs, 2007) and 24.9% in Switzerland (Euromonitor, 2007).

In the UK the rental prices are one of the highest in the world. According to RRPI UK(Residential Rental Price Index) in September 2006 the average rental price was £759 and it grew to £1,034 in September 2007, which is growth of 36.2%.

Starting from 1 July 2007, a smoking ban was applied to all public spaces in the UK, including pubs, restaurants, factories and offices. Of course this was a disadvantage for the smoking target market but as the world population is becoming more health-conscious the expansion of clean and smoke-free premises is more attractive for customers. In addition to this the smoking ban does not apply to outside spaces (http://news.bbc.co.uk, December, 2006).

Considering all the dimensions of the Porter’s diamond there is relatively large number of advantages in demand conditions and firm strategy, structure and rivalry for a nation’s competitiveness. It is reflected in the large size of the market and high demand, rather intensive competition and firm’s strategy and structure. On the other hand factor conditions, related and supporting conditions and government weaken the nation’s competitiveness in terms of labour skills, infrastructure, governmental regulations and restraints. The nation’s competitiveness is of relatively medium scale which gives a chance for the company to be successful in the international field.

Future Strategy

The summary of all the analysis of the domestic and foreign market reflects that Switzerland is rather an attractive market to be penetrated; therefore the Caffè Nero Group should aim for internationalisation starting from this foreign market, Switzerland, for the reason of reactive motives.

The most appropriate market entry strategy would be franchising which would be the most suitable start-up for the company in the foreign market. This entry strategy is most suitable for fast food retail outlets, which this company is actually part of. The main problem is to find the right franchisee who would help to operate the business internationally and to build up the franchisor-franchisee unique organizational relationships.

The value chain approach according to the following entry strategy would be as follows – the production of hot beverages and food, and sales and services should be transferred to the local Caffè Nero outlets in Switzerland in order to maintain productivity and deliver good quality service to the customers, whereas the R&D and marketing should be controlled by the Caffè Nero Group in the Head Office in the United Kingdom.

Recommendations

After analysing Caffè Nero Group externally and internally it is essential to recommend maintaining the strong brand image in the domestic market, by investing a sufficient amount of resources, since the brand positioning is the core of the company’s business model.

Another recommendation is to scan the environment for the intensity of the competition and the new entrants into the market field, thus being able to make proactive decisions for future strategies and defend the market share in the domestic market.

In terms of the internationalisation process it is crucial for the company to find investors in order to maintain all the costs for market entry and future strategies.

Moreover, franchisor-franchisee relationships are the main part of the internationalisation process of the company that could lead either to success or failure, because of the franchisor’s dependence on the franchisee’s motivation to operate a successful business.

Conclusion

The situation analysis of Caffè Nero Group Ltd. reflects that the company has high potential for successful expansion into the European mainland starting from the Swiss market.

The recommendations provided will strengthen its position in the domestic market – the UK – and give the opportunity to successfully enter into the foreign market via the franchising entry mode, where the company will have the opportunity to penetrate the market by using their Continental-style brand image, right promotion campaigns, relatively cheap prices and relaxing atmosphere for leisure and cup of nice coffee.

Appendices

Appendix 1

| Coffee – UK – January 2006 – Market Drivers | ||||||||

| Figure 2: Trends and projections in total UK population, by age group, 1999-2009 | ||||||||

| 1999 | 2004 (est) | 2009 (proj) | % change | % change | ||||

| 0 | % | 0 | % | 0 | % | 1999-2004 | 2004-09 | |

| 0-4 | 3,600 | 6.2 | 3,359 | 5.7 | 3,394 | 5.6 | -6.7 | 1 |

| 9-May | 3,855 | 6.6 | 3,588 | 6 | 3,360 | 5.5 | -6.9 | -6.4 |

| 14-Oct | 3,832 | 6.6 | 3,852 | 6.5 | 3,583 | 5.9 | 0.5 | -7 |

| 15-19 | 3,601 | 6.6 | 3,878 | 6.5 | 3,894 | 6.4 | 7.7 | 0.4 |

| 20-24 | 3,418 | 5.8 | 3,749 | 6.3 | 4,046 | 6.6 | 9.7 | 7.9 |

| 25-34 | 8,697 | 14.9 | 7,939 | 13.4 | 7,661 | 12.6 | -8.7 | -3.5 |

| 35-44 | 8,464 | 14.5 | 9,132 | 15.4 | 8,906 | 14.6 | 7.9 | -2.5 |

| 45-54 | 7,723 | 13.2 | 7,633 | 12.8 | 8,300 | 13.6 | -1.2 | 8.7 |

| 55-64 | 6,026 | 10.3 | 6,905 | 11.6 | 7,332 | 12 | 14.6 | 6.2 |

| 65+ | 9,266 | 15.8 | 9,577 | 16.1 | 10,123 | 16.6 | 3.4 | 5.7 |

| Total | 58,481 | 100 | 59,427 | 100 | 60,598 | 100 | 1.6 | 2 |

| Source: National Statistics/GAD/Minte | ||||||||

Appendix 2

| Coffee – UK – January 2006 – Market Size and Trends | |||||

| Figure 7: UK retail sales of Fairtrade coffee, by value, 2003-05 | |||||

| £m | Index | €m | Index | % of coffee market | |

| 2003 | 17 | 100 | 25 | 100 | 2.9 |

| 2004 | 19 | 112 | 28 | 113 | 3 |

| 2005 (est) | 22 | 126 | 33 | 133 | 3.2 |

| Source: Mintel | |||||

Appendix 3

| Market Sizes – Historic – CHF mn – Value at Current Prices | ||||||

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | |

| Switzerland | ||||||

| Annual savings | 38261.2 | 32062.6 | 31998 | 30702.7 | 31600 | 34000 |

| Sources: | ||||||

| 1. Annual savings: Euromonitor from trade sources/national statistics | ||||||

| Date Exported (GMT/BST): 07/11/2007 14:36:08 | ||||||

| ©2007 Euromonitor International | ||||||

Appendix 4

| Market Sizes – Historic – £ mn – Value at Current Prices | ||||||

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | |

| United Kingdom | ||||||

| Annual savings | 40100 | 32900 | 32200 | 25400 | 30398.2 | 37506.9 |

| Sources: | ||||||

| 1. Annual savings: Euromonitor from trade sources/national statistics | ||||||

| Date Exported (GMT/BST): 09/11/2007 17:25:22 | ||||||

| ©2007 Euromonitor International | ||||||

Appendix 5 Statistical Information for Switzerland

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | |

| Inflation (% change) | 1.0 | 0.6 | 0.6 | 0.8 | 1.2 | 1.1 |

| Exchange rate (per US$) | 1.69 | 1.56 | 1.35 | 1.24 | 1.25 | 1.25 |

| Lending rate | 4.3 | 3.9 | 3.3 | 3.2 | 3.1 | 3.0 |

| GDP (% real growth) | 1.0 | 0.3 | (0.2) | 2.3 | 1.9 | 2.7 |

| GDP (national currency millions) | 422,485.0 | 430,527.0 | 434,764.0 | 447,309.0 | 455,594.0 | 474,580.0 |

| GDP (US$ millions) | 250,345.2 | 276,225.0 | 322,848.6 | 359,717.7 | 365,886.1 | 378,501.2 |

| Population, mid-year (‘000) | 7,229.9 | 7,284.8 | 7,339.0 | 7,389.6 | 7,437.1 | 7,478.1 |

| Birth rate (per ‘000) | 10.2 | 9.9 | 9.8 | 9.9 | 9.8 | 9.7 |

| Death rate (per ‘000) | 8.5 | 8.4 | 8.6 | 8.1 | 8.2 | 8.2 |

| No. of households (‘000) | 3,208.0 | 3,245.7 | 3,270.4 | 3,289.3 | 3,308.6 | 3,326.5 |

| Total exports (US$ millions) | 78,066.4 | 87,358.6 | 100,724.0 | 117,816.0 | 126,083.0 | 141,669.0 |

| Total imports (US$ millions) | 77,070.5 | 82,376.6 | 95,581.3 | 110,321.0 | 119,770.0 | 132,021.0 |

| Tourism receipts (US$ millions) | 7,505.0 | 7,885.0 | 9,169.0 | 10,542.0 | 11,063.0 | 11,345.5 |

| Tourism spending (US$ millions) | 6,235.0 | 6,674.0 | 7,463.0 | 8,779.0 | 9,262.0 | 9,459.7 |

| Urban population (‘000) | 4,877.1 | 4,916.3 | 4,963.2 | 5,002.7 | 5,045.6 | 5,079.6 |

| Urban population (%) | 67.7 | 67.8 | 67.9 | 67.9 | 68.0 | 68.1 |

| Population aged 0-14 (%) | 17.3 | 16.9 | 16.7 | 16.5 | 16.3 | 16.0 |

| Population aged 15-64 (%) | 67.3 | 67.5 | 67.7 | 67.8 | 67.9 | 68.0 |

| Population aged 65+ (%) | 15.4 | 15.6 | 15.6 | 15.7 | 15.8 | 16.0 |

| Male population (%) | 48.9 | 48.8 | 48.9 | 48.9 | 48.9 | 49.0 |

| Female population (%) | 51.1 | 51.2 | 51.1 | 51.1 | 51.1 | 51.0 |

| Life expectancy male (years) | 77.5 | 77.9 | 78.0 | 78.6 | 78.7 | 78.9 |

| Life expectancy female (years) | 83.2 | 83.2 | 83.2 | 83.8 | 84.0 | 84.1 |

| Infant mortality (deaths per ‘000 live births) | 5.0 | 4.5 | 4.3 | 4.2 | 4.1 | 4.0 |

| Adult literacy (%) | 99.9 | 99.9 | 99.9 | 99.9 | 99.9 | 99.9 |

Appendix 6 Statistical Information about UK

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | |

| Inflation (% change) | 1.8 | 1.6 | 2.9 | 3 | 2.8 | 3.2 |

| Exchange rate (per US$) | 0.69 | 0.67 | 0.61 | 0.55 | 0.55 | 0.54 |

| Lending rate | 5.1 | 4 | 3.7 | 4.4 | 4.6 | 4.6 |

| GDP (% real growth) | 2.4 | 2.1 | 2.7 | 3.3 | 1.9 | 2.7 |

| GDP (national currency millions) | 1,003,300.00 | 1,055,790.00 | 1,118,240.00 | 1,184,300.00 | 1,233,980.00 | 1,299,620.00 |

| GDP (US$ millions) | 1,444,314.10 | 1,582,364.50 | 1,825,781.40 | 2,168,332.80 | 2,243,608.20 | 2,391,262.30 |

| Population, mid-year (‘000) | 59,108.70 | 59,327.70 | 59,568.80 | 59,879.90 | 60,226.50 | 60,550.10 |

| Birth rate (per ‘000) | 11.3 | 11.3 | 11.7 | 12 | 12 | 12.2 |

| Death rate (per ‘000) | 10.2 | 10.2 | 10.3 | 9.7 | 9.7 | 9.7 |

| No. of households (‘000) | 25,388.00 | 25,560.50 | 25,731.20 | 25,900.30 | 26,067.70 | 26,233.50 |

| Total exports (US$ millions) | 267,349.00 | 276,299.00 | 304,185.00 | 341,596.00 | 371,370.00 | 428,359.00 |

| Total imports (US$ millions) | 320,973.00 | 335,438.00 | 380,712.00 | 451,680.00 | 483,017.00 | 547,476.00 |

| Tourism receipts (US$ millions) | 18,864.00 | 20,549.00 | 22,668.00 | 28,202.00 | 30,577.00 | 30,757.70 |

| Tourism spending (US$ millions) | 37,931.00 | 41,744.00 | 47,853.00 | 56,444.00 | 59,593.00 | 61,929.00 |

| Urban population (‘000) | 52,471.10 | 52,702.70 | 52,935.60 | 53,201.00 | 53,571.60 | 53,916.20 |

| Urban population (%) | 88.9 | 89 | 89.1 | 89.1 | 89.2 | 89.3 |

| Population aged 0-14 (%) | 18.9 | 18.7 | 18.5 | 18.2 | 18.1 | 17.8 |

| Population aged 15-64 (%) | 65.3 | 65.4 | 65.6 | 65.8 | 65.9 | 66.2 |

| Population aged 65+ (%) | 15.8 | 15.9 | 15.9 | 16 | 16 | 16 |

| Male population (%) | 48.7 | 48.8 | 48.9 | 48.9 | 48.9 | 49 |

| Female population (%) | 51.3 | 51.2 | 51.1 | 51.1 | 51.1 | 51 |

| Life expectancy male (years) | 75.8 | 76 | 76.2 | 76.8 | 77.1 | 76.8 |

| Life expectancy female (years) | 80.5 | 80.6 | 80.5 | 81 | 81.1 | 81.3 |

| Infant mortality (deaths per ‘000 live births) | 6.2 | 5.9 | 6 | 5.8 | 5.6 | 5.6 |

| Adult literacy (%) | 99.6 | 99.7 | 99.7 | 99.8 | 99.8 | 99.8 |

Appendix 7

References

UK National Statistics website – http://www.statistics.gov.uk/downloads/theme_labour/LALM_statistical_indic ators_Oct07.pdf, October 2007 – viewed 05/11/07

Rent Right estate agency website – http://www.rentright.co.uk/00_00_00_00_00_rrpi.aspx, September 2007 – viewed 8/11/07

BBC News official website – http://news.bbc.co.uk/1/hi/uk_politics/6196910.stm, December, 2006 – viewed 8/11/2007

The Scotsman – Scotland National Paper online – http://thescotsman.scotsman.com/business.cfm?id=1635892005, 16th July 2005 – viewed 4/11/07

Personneltoday.co.uk – Interactive business and professional magazine online – http://www.personneltoday.com/articles/2006/05/02/35151/sector-insight-coffee-beings.html, 2nd May, 2006 – viewed 5/11/07

Food and Grocery Information – Insight and Best Practice – http://www.igd.com/CIR.asp?menuid=67&cirid=2042,14/08/2006 – viewed 6/11/2007

Food and Grocery Information – Insight and Best Practice – www.igd.com/CIR.asp?menuid=66&cirid=2068, 5th October, 2006 – viewed 6/11/2007

Personneltoday.co.uk – Interactive business and professional magazine online – http://www.personneltoday.com/articles/2007/08/13/41876/manufacturing-skilled-labour-shortages-set-to-hamper-small-firms-ability-to-meet-demand.html, 13 August 2007 – viewed 1/11/2007

Itim International – Geert Hofstede’s official website – www.geert-hofstede.com, 1967-2003 – viewed 2/11/07

Currency Converter website – http://www.gocurrency.com/countries/switzerland.htm, 2005 – viewed 2/11/07

Wikipedia – The free encyclopedia – http://en.wikipedia.org/wiki/Switzerland, 2007 – viewed 6/11/2007

Wikipedia – The free encyclopedia – http://en.wikipedia.org/wiki/UK, 2007 – viewed 6/11/2007

The Telegraph online – http://www.telegraph.co.uk/news/main.jhtml?xml=/news/2007/11/04/ncoffee104.xml, 5th November, 2007 – viewed 5/11/2007

BBC News Official Website – http://news.bbc.co.uk/1/hi/business/6566715.stm, 18th April 2007 – viewed 8/11/2007

Marketing Case Studies – http://www.utalkmarketing.com/pages/Article.aspx?ArticleID=2591 – viewed 2/11/2007

Datamonitor International Database – www.datamonitor.com, 2007 – viewed 1-8th November, 2007

Euromonitor International Database – www.euromonitor.com, 2007 – viewed 1-8h November, 2007

Mintel Database – www.mintel.com, 2007 – viewed 1-8th November, 2007

Svend Hollensen (2007) Global Marketing, Pearson Education Limited (4th Edition), Essex, England, pp 394-5, 335-8

Stefan, C., Wolter, B. & Weber, A. (1999), “Skilling the unskilled – a question of incentives?”, International Journal of Manpower, pp 254-269

HM Revenue and Customs Official website – http://www.hmrc.gov.uk/businesses/tmacorporate-tax.shtml, 2007 – viewed 8/11/2007

Mead, R. (2005) “Cross Cultural Dimensions”, International Management Cambridge, Blackwell, pp 27-54

Caffè Nero Group Ltd. official website – www.caffenero.com